In this week’s subscriber edition of Payments, Payments, Payments we take a look at the invention of the cash dispensing Automated Teller Machine (ATM).

It is claimed that the world's first ATM was unveiled at Barclays Bank in Enfield in June 1967, but the real inventor of the bank cash machine has been a source of dispute for years.

Who invented the ATM?

Over the years many people have tried to lay claim to the title of ‘inventor of the ATM’. The answer is not straight forward with Americans, Scots and Japanese all claiming the “inventor crown”.

A few years ago ATMInventor.com posted an article exploring six potential contenders for the ATM inventor crown. The article concluded that Luther George Simjian invented the idea of an ATM in the 1930’s and, perhaps controversially, that James Goodfellow, not John Shepherd-Barron, actually invented the ATM as we know it today.

In the late 1930's, Luther George Simjian started building an earlier and not-so-successful version of an ATM. He did register related patents. He initially came up with the idea of creating a "hole-in-the-wall machine." It would allow customers to make financial transactions, without entering the bank. The idea was met with a great deal of doubt. Starting in 1939, Simjian registered 20 patents related to the device and persuaded what is now Citicorp to give it a trial. After six months, the bank reported that there was little demand.

The Japanese claim to the crown relates to a cash dispensing device launched in 1966 that was linked to a loan account rather than a bank account.

The race between Barclays Bank and Westminster Bank

This article focuses on the invention of the ATM in the UK and a battle between Barclays Bank and Westminster Bank to deploy the UK’s first cash dispensing ATM.

James Goodfellow is the man who first patented automated cash machines that used PIN numbers. James lodged his patent in May 1966, more than a year before the first cash machine was ceremonially opened in a blaze of publicity.

However, on the 27 June 1967, comedy actor Reg Varney, from the ITV comedy “On The Buses”, took money from a cash machine dispenser at a Barclays branch in Enfield, north London, but this was not the ATM card and Pin solution we know today.

The Barclays machine was developed by John Shepherd-Barron and this solution beat James Goodfellow's machines, which were installed at branches of Westminster Bank (later to become NatWest), by just a month.

There was clearly healthy payments competition in the Clearing Banks of the 1960’s.

This suggests that John Shepherd-Barron invented a cash dispensing machine and James Goodfellow patented the ATM system that eventually achieved widespread global adoption.

The two approaches were very different:

John Shepherd-Barron's (Barclays)

In a typical inventor eureka moment the official Barclays archives report that like many of the best inventions, “the ATM was developed as a result of frustration. John Shepherd-Barron, Managing Director at banknote manufacturer De La Rue, found himself unable to cash his cheques after his bank closed on a Saturday morning. Pondering the dilemma in the bath later that evening, he was inspired by chocolate vending machines to create something similar for cash.”

Barclays archive also provides an insight into the origins of the Personal Identification Number (PIN): “Realising the machine would need a way to identify individual customers, Shepherd-Barron, an army veteran, initially thought of his personal army number and suggested a six-figure identifier. But after his wife Caroline claimed she couldn’t remember more than four digits, he settled on the four digit PIN we use today, setting a standard that would operate worldwide for the next half-century.”

On 27 June 1967, according to Barclays, the world’s first ATM (automated teller machine) was ceremoniously unveiled at a branch of Barclays Bank in Enfield, north London.

The then Barclays deputy chairman Sir Thomas Bland was given the honour of drawing back a velvet curtain installed for the purpose, while comedy actor Reg Varney, best known for the sitcom On the Buses, made the first withdrawal – although he wasn’t suddenly cash rich, as the machine only permitted users to withdraw £10 at a time.

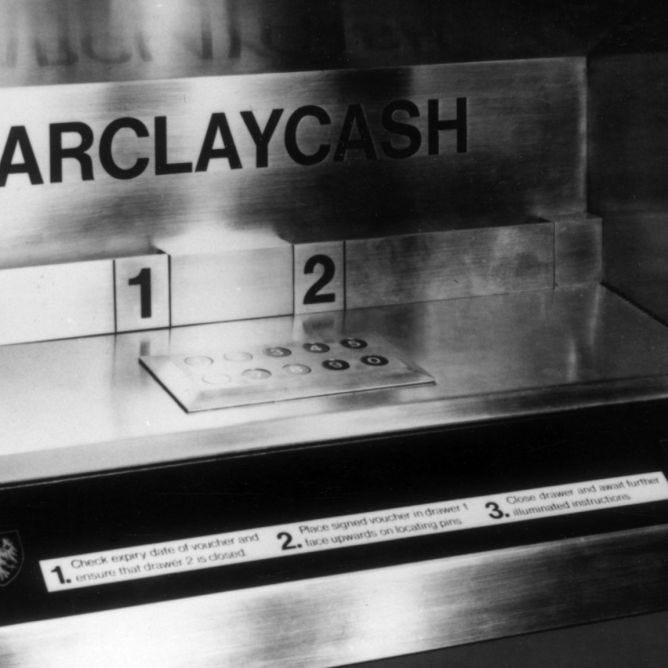

John Shepherd-Barron's (Barclays) machine:

Did not use plastic cards, instead it used cheques that were impregnated with carbon 14, a mildly radioactive substance. John calculated that you’d need to eat 136,000 of these cheques for the radiation to have an effect at all on your body.

The machine matched the cheque against a Pin (personal identification number).

Shepherd-Barron worked for banknote manufacturer De La Rue who did not patent the machine because they did not want fraudsters knowing how the system worked.

James Goodfellow's (Westminster Bank)

James Goodfellow’s (Westminster Bank) machine launched just a month later:

Used a plastic card and PIN which became the forerunner of the system we recognise today.

So perhaps James Goodfellow’s claim to have been the real inventor of the cash machine has some merit. However, James Goodfellow doesn't seem to like to talk about the years in which John Shepherd-Barron got all the credit.

In a 2009 BBC documentary James said:

It really does raise my blood pressure. My patent was licensed by all the manufacturers. They thought that was the way to go. The race to get it on to the street was not as important. Getting it right was the answer, not getting it first.

James Goodfellow was working as development engineer for Glasgow firm Kelvin Hughes in the mid-1960s when he got involved in a project to design a machine that could dispense money to customers when banks were closed.

In an interview with BBC Scotland he explained the background driving the development of a cash dispensing machine:

The unions were putting pressure on banks to close on Saturday mornings.

Most people worked during the week and could not get to the bank, which closed at 3pm on weekdays.

Many people went to the bank on Saturday mornings but the unions were pressing for staff to work a five-day week.

The banks wanted a way to give working people access to their money when they were closed.

The problem with cash machines was access, how would a genuine customer, and only a genuine customer, get money out of it? with 1960’s technology.

The solution James Goodfellow identified was an "exotic token", a piece of paper or plastic with "uncommon characteristics" that a machine would recognise.

In a typical inventor eureka moment he hit upon the idea of the Personal Identification Number (PIN). This was the vital security measure that would make the system work, the number would be known to the customer and the bank and could be related to the card but not read by anyone else.

This forerunner of the ATM we know today was patented in May 1966, more than a year before Barclays unveiled the first ATM in London.

Translating a patented idea into a reality faced a significant challenge the bank wanted any of their one million customers to be able to access any one of 2,000 machines.

The cards he used were one quarter of a "Hollerith" punch-card 9 containing 30 bytes of data), which just happens to be the same size as today's credit card.

Getting it right was the answer, not getting it first.

There have been arguments for years over who should officially go down in history as "the inventor of the ATM".

In 2005, John Shepherd-Barron received an OBE in the New Year honours list for services to banking as the "inventor of the automatic cash dispenser". When hearing about he award John is quoted as saying:

It was a bit late, but better late than never.

However James Goodfellow, the man who patented the invention, has regained his place. In 2006 he received an OBE for services to banking as "patentor of the personal identification number".

He has also been placed in the Scottish engineering hall of fame alongside John Logie Baird, the inventor of the television.

James Goodfellow even makes an appearance in a Home Office guide book aimed at those seeking UK citizenship. The book, called Life in the United Kingdom, has about "great British inventions of the 20th century".

It says:

In the 1960s, James Goodfellow (1937-) invented the cash-dispensing automatic teller machine (ATM) or 'cashpoint'.

Noun: The Hole In The Wall

One of the earliest references to the “hole in the wall” was published by The Guardian on the Saturday 27th September 1980 in an article “they are no better but much the same”:

All the big four—National Westminster, Barclays, the Midland, and Lloyds—will offer you banking without bank charges at least while you are getting full-time education. If you pay in your first grant cheque, other goodies may appear. National Westminster and the Midland will provide a cheque guarantee card immediately, backing each cheque you write for up to £50, and though Lloyds may make you sweat for it, the card should appear within three to six months.

Getting shops to take cheques without the guarantee is not easy, but Lloyds will usually provide a cash card which you can insert in one of those hole in the wall computers which will spit out money—in limited helpings.

In the 1980’s price incentives were used to encourage customers to use the hole in the wall.

On the 31 December 1980 The Guardian published:

National Westminster, Britain’s biggest bank, is to cut the cost of its personal loans in the new year—but is also taking the chance to put up its bank charges.

The big change on the bank charges front lies in the cost of putting a debt item through the system. NatWest will raise the levy from 15p to 18p for most items, but is actually lowering the rate for withdrawals from the hole-in-the-wall cash points and for direct debits; the bank will now charge 12p rather than 15p for them. Officials want to encourage personal customers to use them, because neither of them involves sending paper through the banking system.

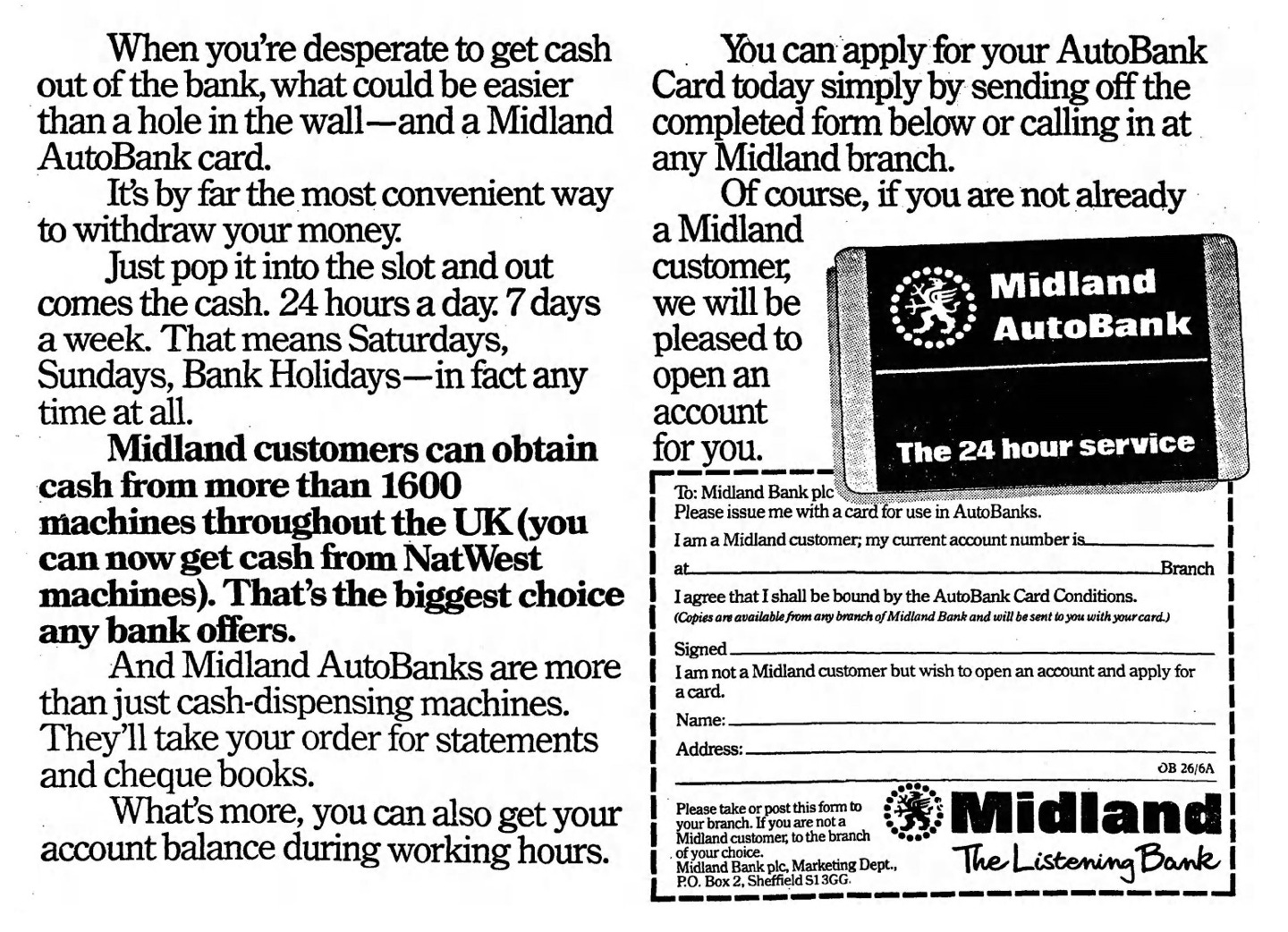

Midland Bank, published the following advert in The Observer on Sunday 26th June 1983:

Brief (and incomplete) ATM Timeline

1967: The world's first ATM is installed at a Barclays branch in Enfield, London and unveiled by comedy actor Reg Varney. The next five ATMs were installed in Hove, Ipswich, Southend, Luton and Peterborough.

1969: Midland Bank rolls out its own ATM’s

1972: Lloyds Bank ‘Cashpoint’ is the first on-line verified ATM using payment cards with a magnetic stripe

1970s, banks in the UK begin to producing perforated cash withdrawal cards with magnetic strips and four-digit PIN codes.

1975: With 257 ATMs and over 175,000 users, Barclays raises their withdrawal limit from £10 to £50.

1985: LINK cash machine network established

1986: Matrix cash machine network established

1987: Four bank cash machine network established (Barclays, Lloyds, RBS, BoS)

1989: MINT cash machine network established

1989: LINK and Matrix cash machine networks merge

1993: Half of UK adults are regular users of cash machines

1996: One-billionth cash machine transaction processed by LINK

1996: The average UK cash machine withdrawal exceeds £50 for the first time

1998: UK’s first cash machine not owned by a financial institution installed by Bank Machine

1998: The UK’s first “drive through” cash machine was opened by Barclays at Hatton Cross, near Heathrow Airport.

2000: Cash machine networks consolidate at LINK

2000: General withdrawal of charges for using cash machines across the bank-owned cash machine estate

2001: First year that cash machine withdrawals exceeded one billion during the year.

2002: More than half of all cash acquired by UK adults is acquired through cash machines. Mobile-phone top ups become available at cash machines for the first time

2003: The mainland UK’s first cash machine dispensing Euro notes installed at Old Broad Street in London by NatWest

2012: RBS launched a service for Natwest and RBS customers to withdraw up to £100 from an ATM using a 6 digit code generated on their mobile app

ATM’s today

The UK’s cash machine (ATM) network is operated by a Payment System Operator called LINK.

Effectively every cash machine in the UK is connected to LINK, and LINK is the only way banks and building societies can offer their customers access to cash across the whole of the UK. All the UK's main debit and ATM card issuers are LINK Members.

Cash machine operators join LINK in order to offer cash to the 100 million plus LINK-enabled UK cards in circulation.

The LINK Network is a fundamental part of the UK's payments infrastructure and cash machines are by far the most popular channel for cash withdrawal in the UK, used by millions of consumers every week.

The total value of LINK cash withdrawals can exceed £10 billion per month and at its busiest, LINK processes over 22,000 transactions a minute.

The transition to a digital (cashless) payment society has been a reality for a number of years and its pace has been accelerated by the COVID19 pandemic.

The number of weekly ATM transactions has been in a year on year decline (the blue lines represent 2017, 2018 and 2019) and this has been accelerated in 2020 by the COVID19 pandemic.

From a peak in 2015 the numbers of ATM’s in the UK has been declining:

Transactions within LINK are declining:

As we become an increasingly digital company the challenges for the regulators, the banks and LINK are:

maintaining the availability of cash to end users

the cost of maintaining the supply of cash

ensuring the acceptability of cash by retailers.

Footnote

It seems that John Shepherd-Barron’s ability to predict the future did not stop with the ATM.

In an interview with BBC Business in 2007, just three years before his death aged 84, the revolutionary inventor predicted that:

We will soon be swiping our mobile phones at till points, even for small transactions.

And finally…

The world's highest ATM is located at the Khunjerab Pass in Pakistan and is at an elevation of 4,693 metres (15,397 ft) and operated by the National Bank of Pakistan. The ATM is designed to work in temperatures as low as -40 degree Celsius.

Read, subscribe and share:

Don’t forget to subscribe and share my Payments, Payments, Payments newsletter:

Thanks

Mike