This week’s subscriber only edition of Payments:Unpacked Extra! delivers three mini-briefings:

Which country leads real-time payments (by volume)

What fintechs need to know about ‘Request to Pay’ by Anders la Cour at Banking Circle

What is happening at the UK’s ATMs

Who leads real-time payments?

Just before the pandemic hit is I was in the Middle East talking payments strategy. The UK’s Faster Payments system was described as ‘the granddaddy of all instant payment systems’, this made me proud of what we have achieved in the UK payment space (and my small part in it!)

What also became clear is that every deployment of an instant payment system faces the same broad challenges:

establishing a clear point of settlement finality

the role of ‘alias’ overlays to stimulate growth in P2P payment adoption

real time fraud and sanction screening in an ‘instant’ world

applying the defacto ISO 20022 message standard

the role of bulking / debulking of payments

identifying and measuring key SLA’s

delivering uptime.

The same broad challenges are faced by each geography and it’s interesting to see how they are being resolved in each system.

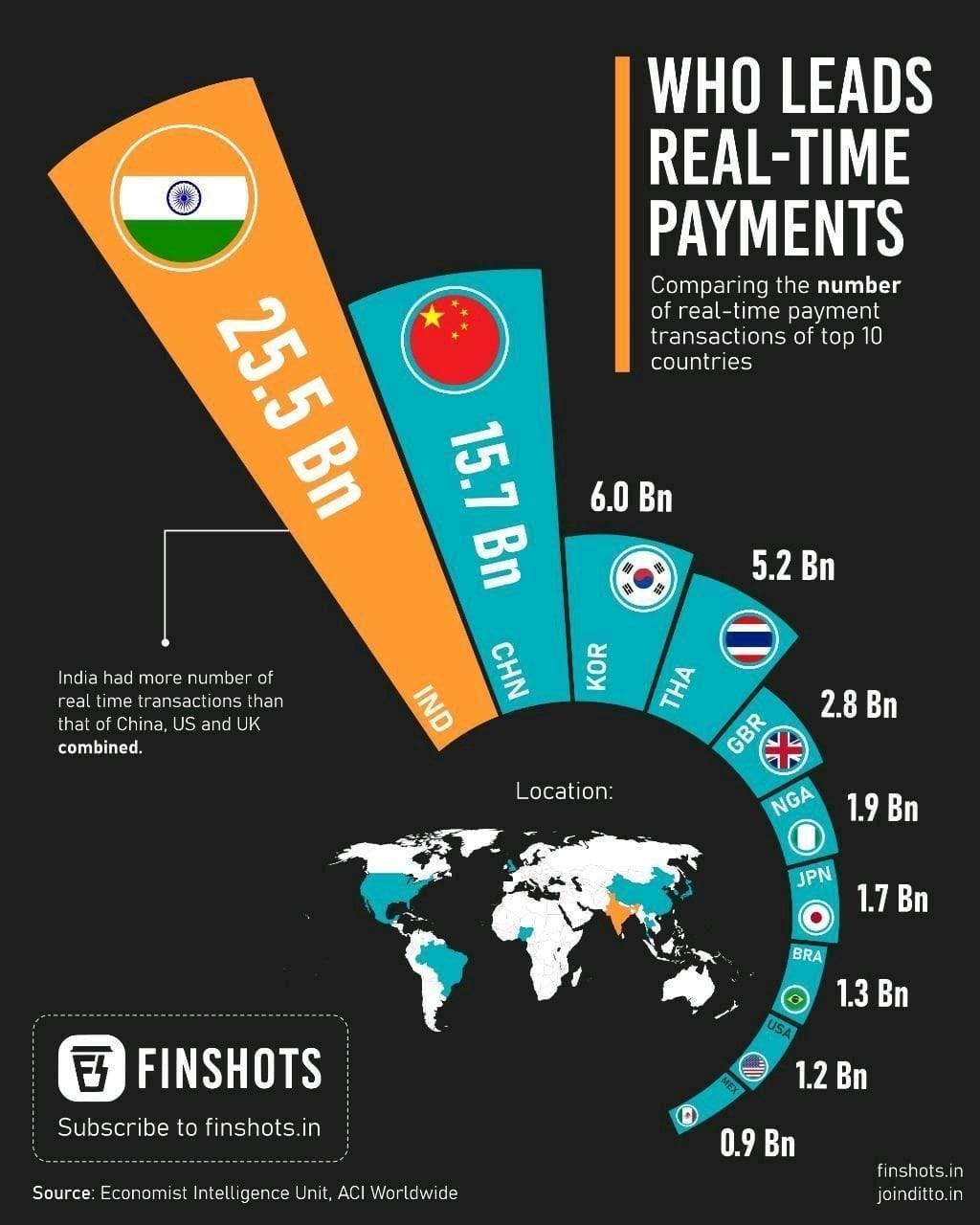

India has a greater number of real time transactions that China, the US and the UK combined!

ACI Worldwide have published an interesting infographic comparing the number of real time transactions of top 10 countries (make your own adjustments such as per-capita volumes).

More: Faster Payments: The world's first 24*7*365 instant payments system

Keep reading with a 7-day free trial

Subscribe to Payments:Unpacked to keep reading this post and get 7 days of free access to the full post archives.