Wallets Left Behind and Convenience Wears The Crown

LINK’s (the operator of the UK’s ATM network) latest research reveals a striking shift in UK payment habits: fewer than half of adults now leave home with a wallet or purse - a reality that would have been unthinkable just a decade ago.

LINK’s report “Tapping into trouble? The UK’s growing digital payment dependency” addresses three key issues:

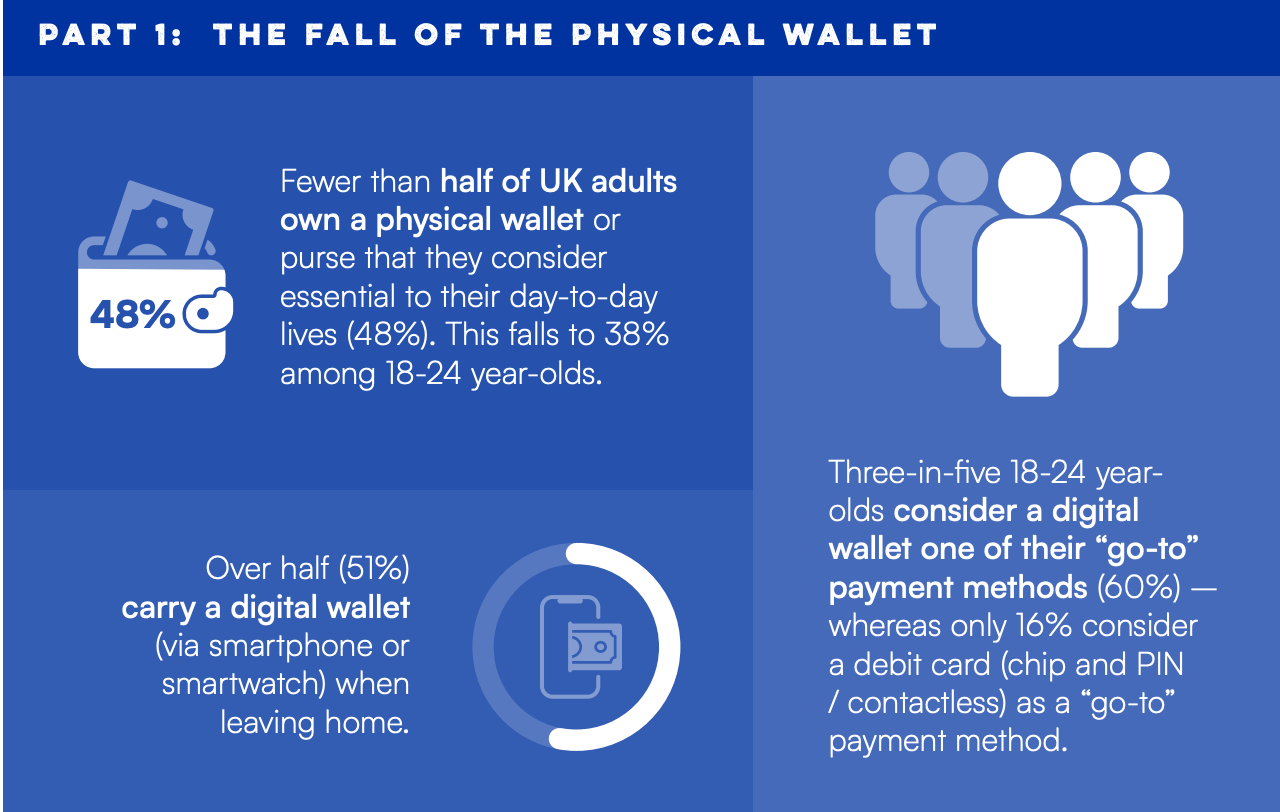

The fall of the physical wallet

Source: LINK

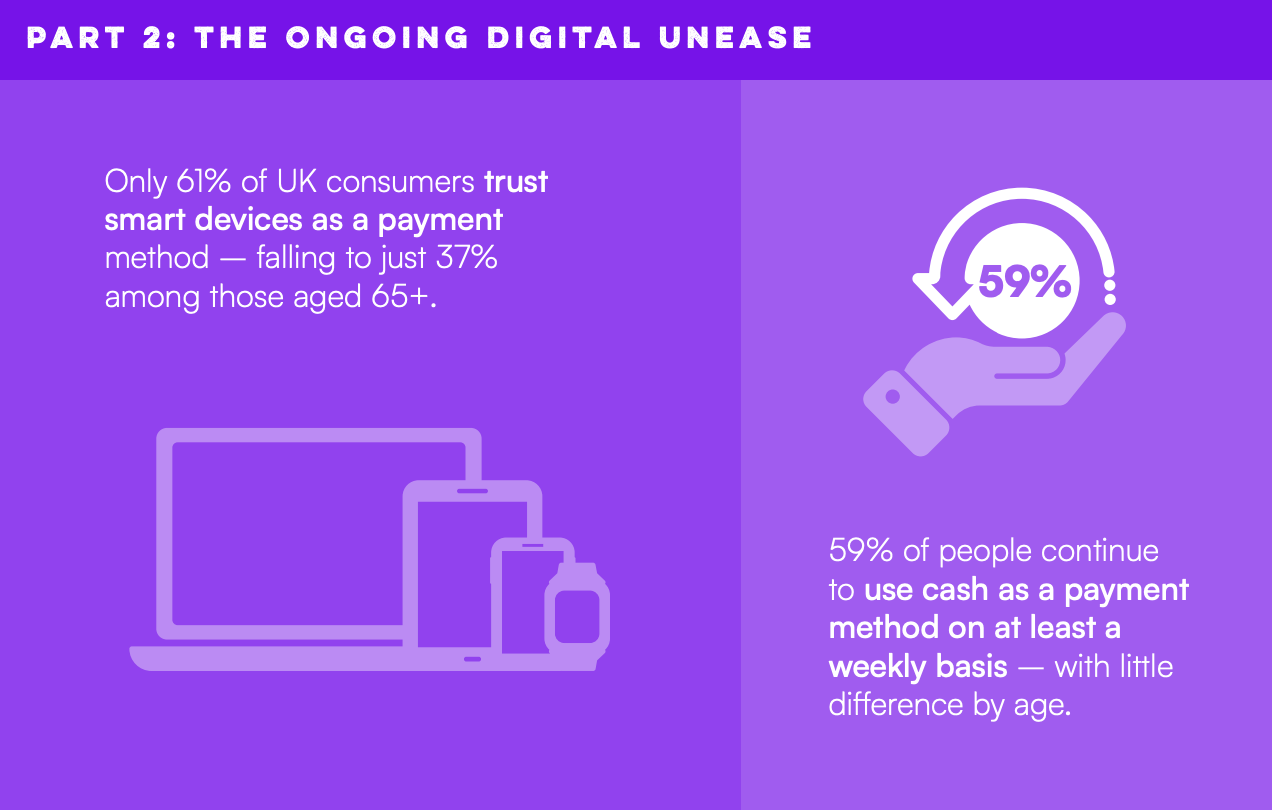

The Ongoing Digital Unease

With digital payments becoming the default, the study explores how our payments system can remain resilient and reliable, while also offering practical tips for consumers to safeguard themselves if digital payments ever fail.

Source: LINK

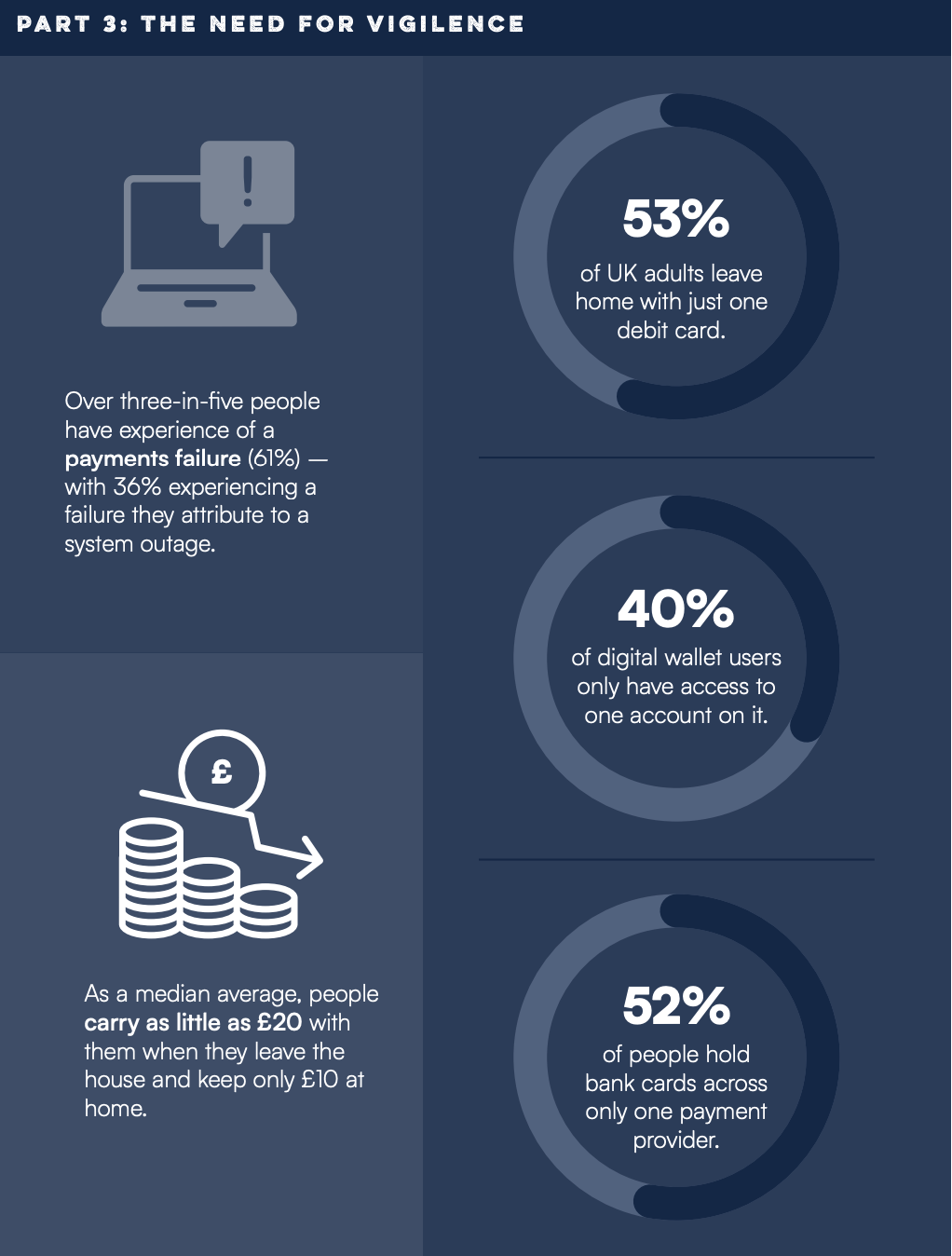

The need for vigilence

Source: LINK

Evolving Payments, Practical Protection

Adrian Roberts, Deputy CEO of LINK:

Digital payments offer unparalleled convenience, but they also come with risks. Many consumers have told us they’re not yet fully confident in the reliability of these systems. It’s vital we protect cash as a payment method while improving digital resilience and inclusivity. Our report highlights how payment habits are evolving and shares practical steps consumers can take to avoid disruption.

Tapping into trouble?

The UK’s growing digital payment dependency

Discover the full insights and guidance - download the complete report to see how you can stay prepared in a digital-first world.

Keep reading with a 7-day free trial

Subscribe to Payments:Unpacked to keep reading this post and get 7 days of free access to the full post archives.