Understanding UK Payments | 10 Essential Insights

Each year the UK Payment Markets 2025 report published by UK Finance provides detailed commentary on trends in payment markets. The report includes statistical tables of historic and forecast data for payments and cash acquisition between 2014 and 2034.

A summary of the latest report (it will be a while before 2025 data is published) can be found at: UK Finance - UK Payment Markets 2025 and the full report is available free of charge for some members of UK Finance and available for purchase by others at: www.ukfinance.org.uk.

Volume or Value?

A central banker might argue value but as a former custodian of the UK's systemically important retail payment schemes I'd argue volume any day!

Understanding UK Payments | 10 Essential Insights

Here’s ten essential insights into understanding UK Payments from the UK Finance report:

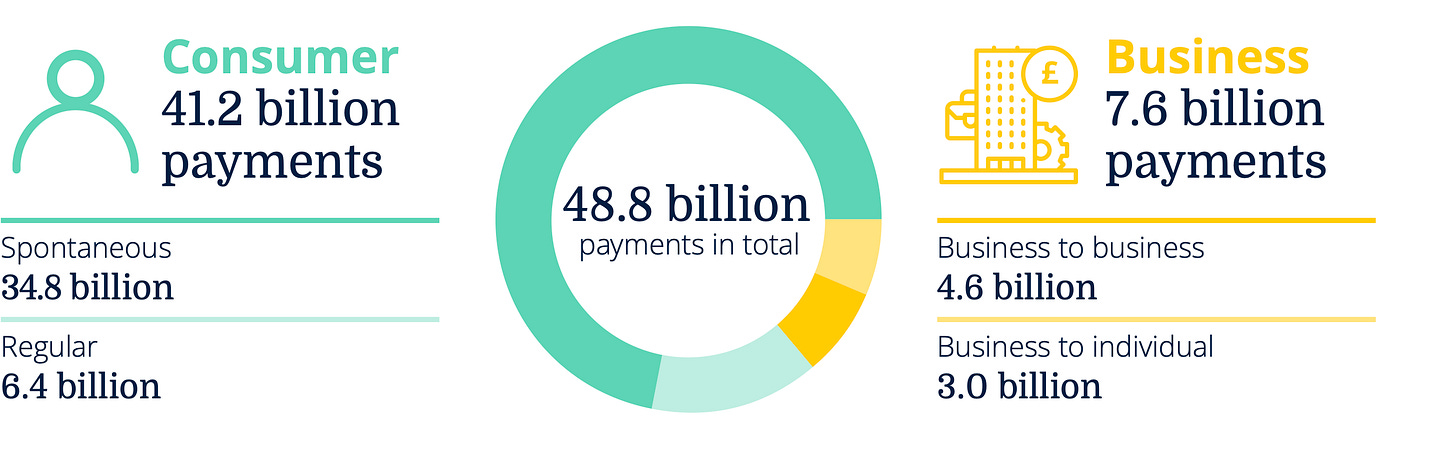

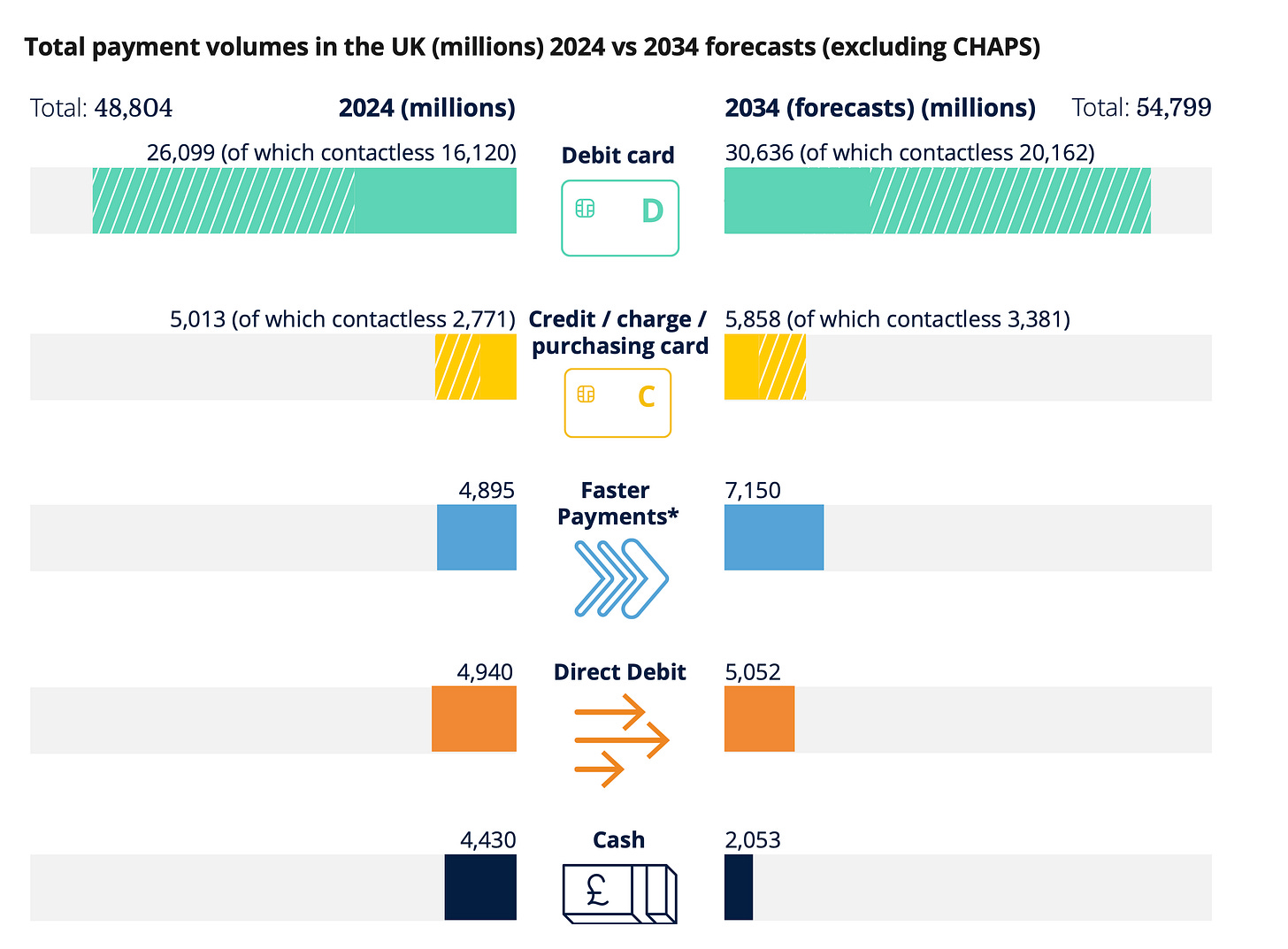

Nearly 50 billion payments are made in the UK every year

Source: UK Finance

Debit Cards Account for 53% of payments

Source: UK Finance

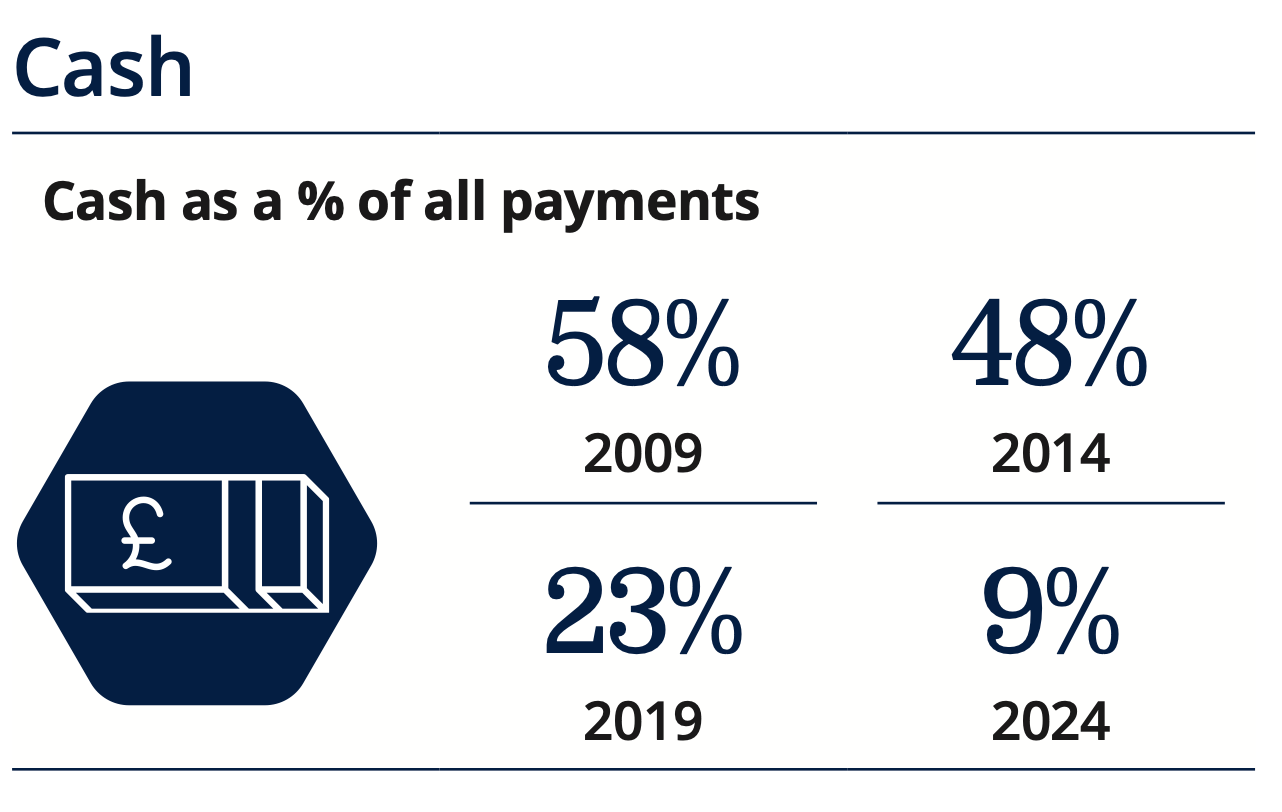

Cash payments only accounts for 9% of payments

Source: UK Finance

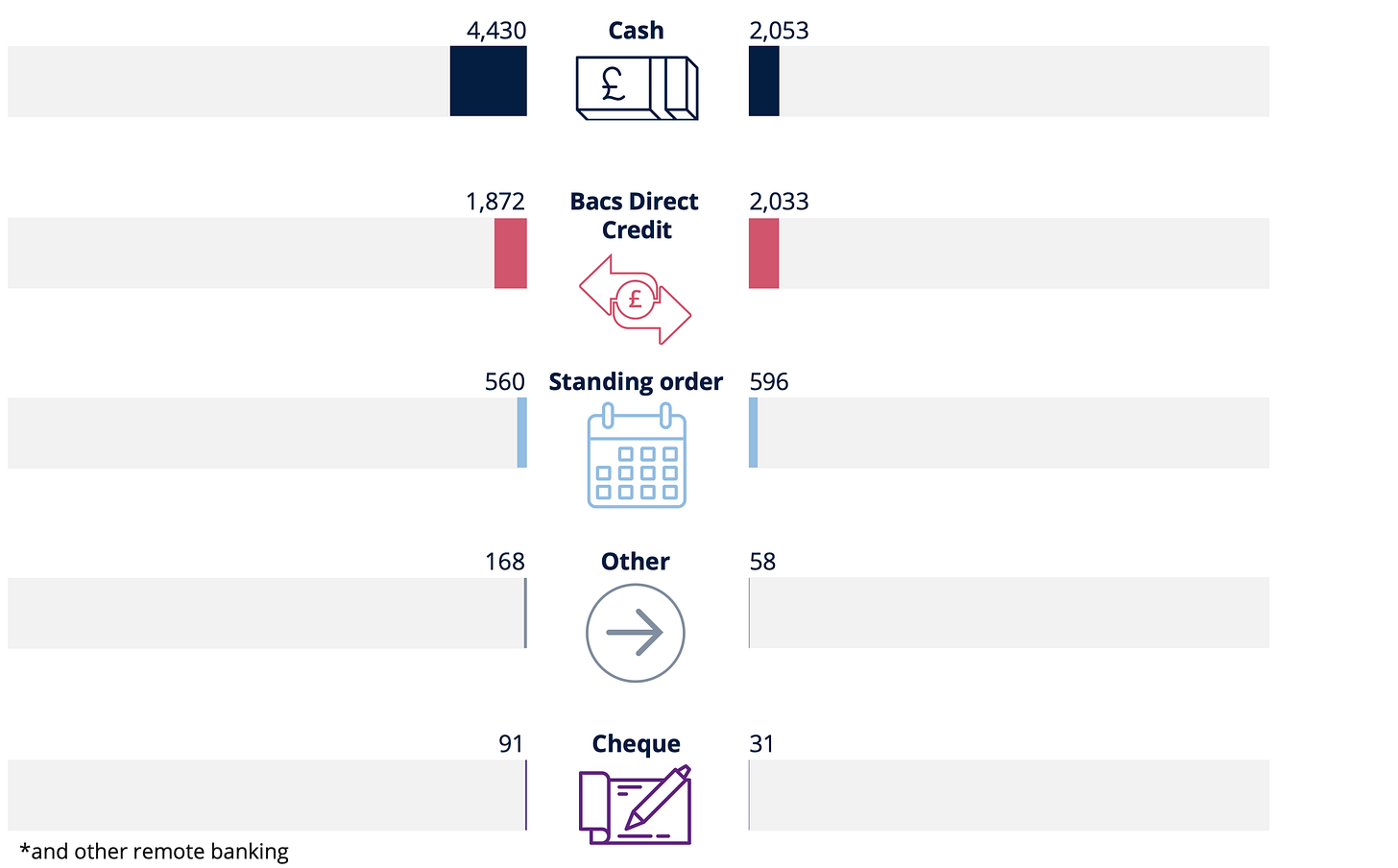

Cash payments in the UK continued their long-term decline, dropping to 4.4 billion in 2024 and falling from 12% to 9% of all transactions. For the first time, cash was no longer the second most used payment method, overtaken by Direct Debits, Faster Payments, and credit cards.

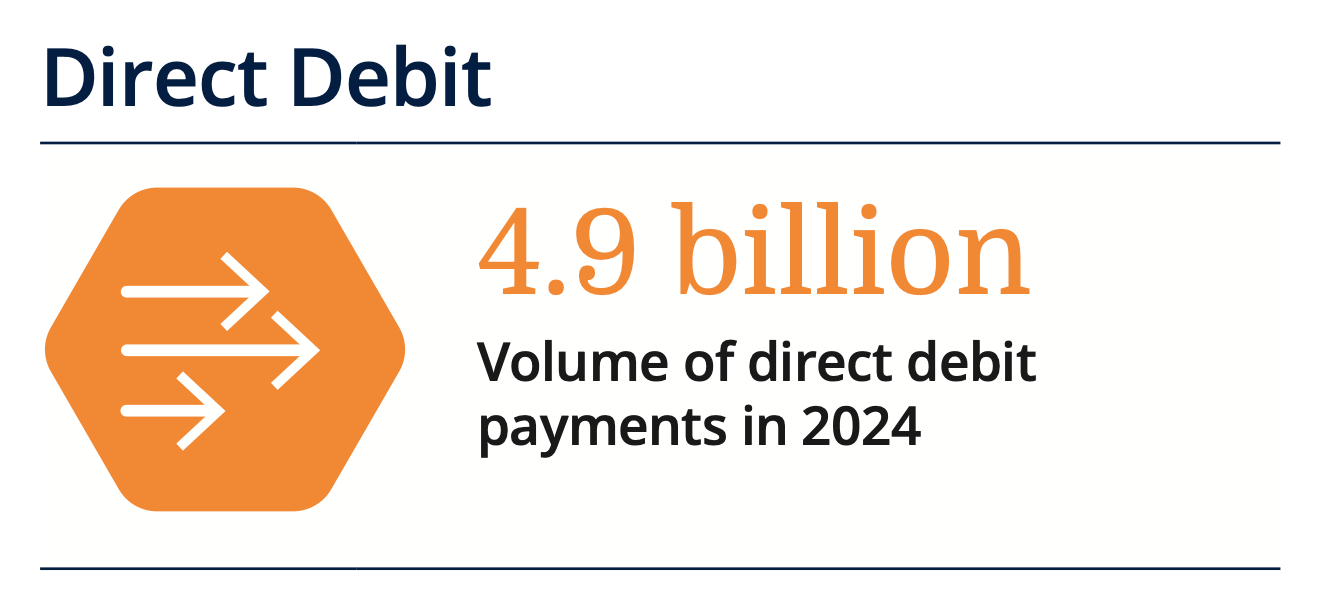

Almost 5 Billion Direct Debit Transactions are processed each year

Source: UK Finance

In 2024, UK consumers made 4.9 billion Direct Debit payments worth £1,486 million, covering about 70% of all regular bill payments. Volume growth was modest, reflecting population and household increases rather than a surge in usage.

Spoiler alert: When Pay.UK publish the December 2025 payment statistics it is likely (probable) that Direct Debit will reach the dizzy heights of 5 billion transactions processed in 2025!

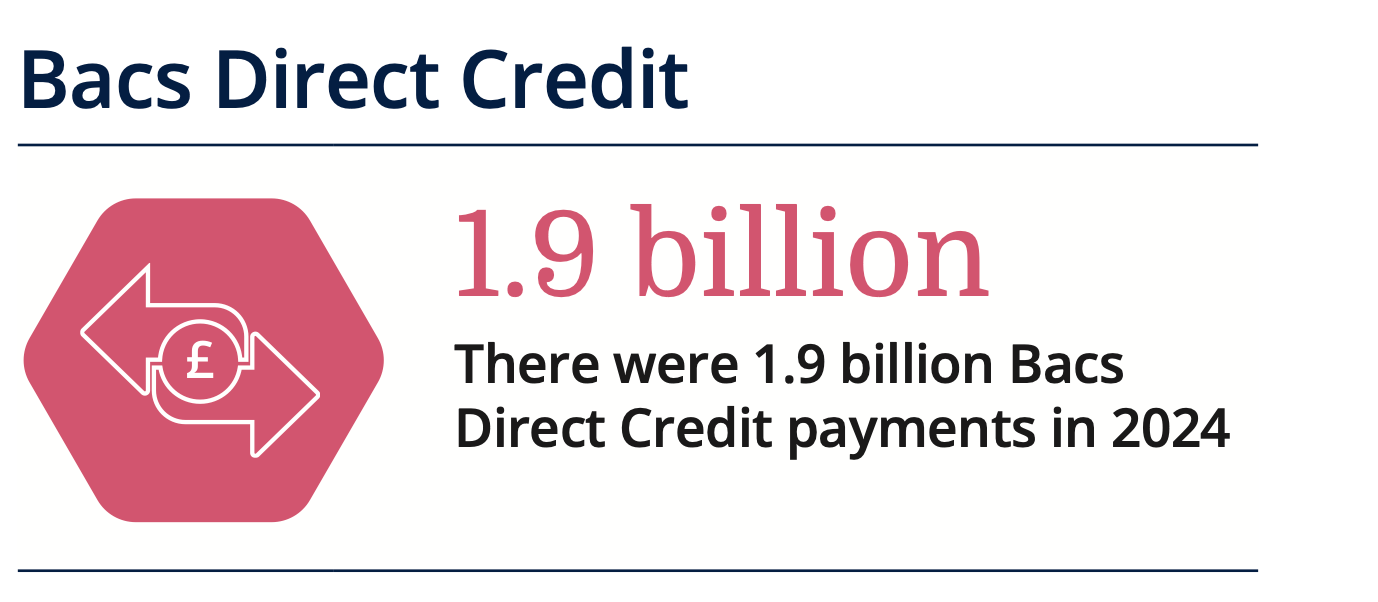

1.9 Billion Bacs Direct Credit transactions were processed in 2024

Source: UK Finance

Bacs Direct Credit remains a key method for businesses and the government to make predictable bulk payments, including wages and state benefits, accounting for 25% of all business payments in 2024. Although its share has declined from over half a decade ago, total payments are expected to stay stable, with around 2 billion projected by 2034.

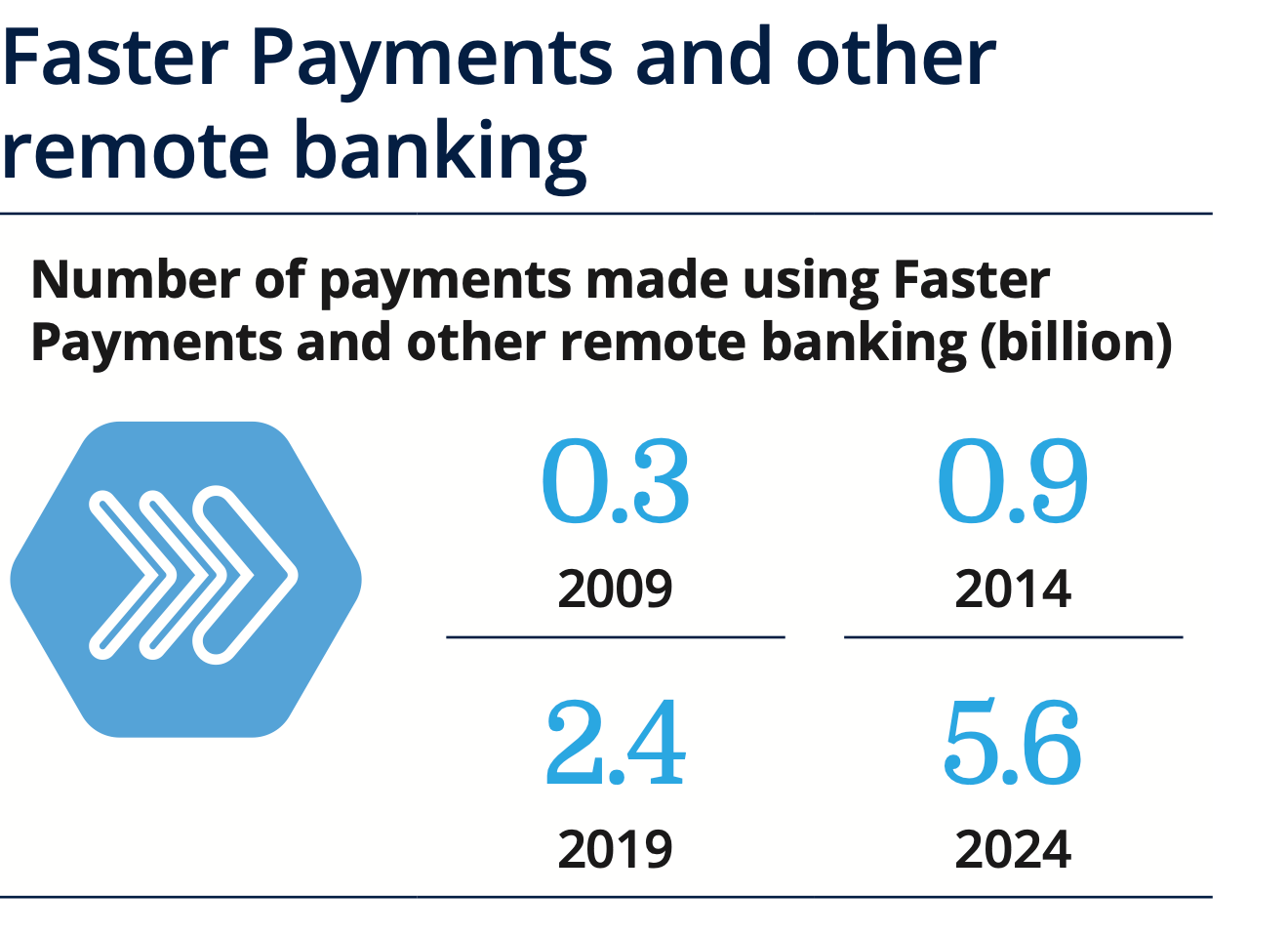

Faster Payments growth continues almost unabated

Source: UK Finance

Faster Payments accounted for 50% of all business payments in 2024, having overtaken Bacs Direct Credit as the most-used method. Use of Faster Payments and remote banking is set to surge, reaching an estimated 7.2 billion payments by 2034.

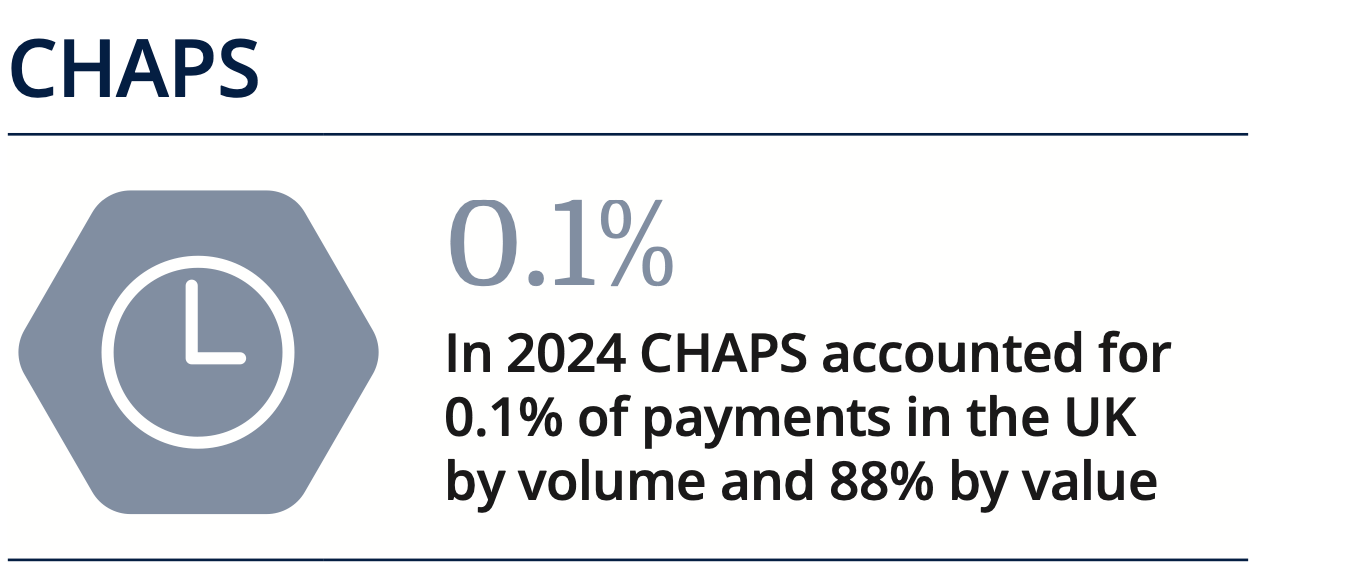

CHAPS represents just 0.1% of the volume but 88% of the value

Source: UK Finance

CHAPS, used mainly for wholesale and corporate treasury payments, made up just 0.1% of UK payment volumes in 2024, with 52.7 million payments totaling £87.5 trillion. Its usage closely mirrors the state of the UK economy.

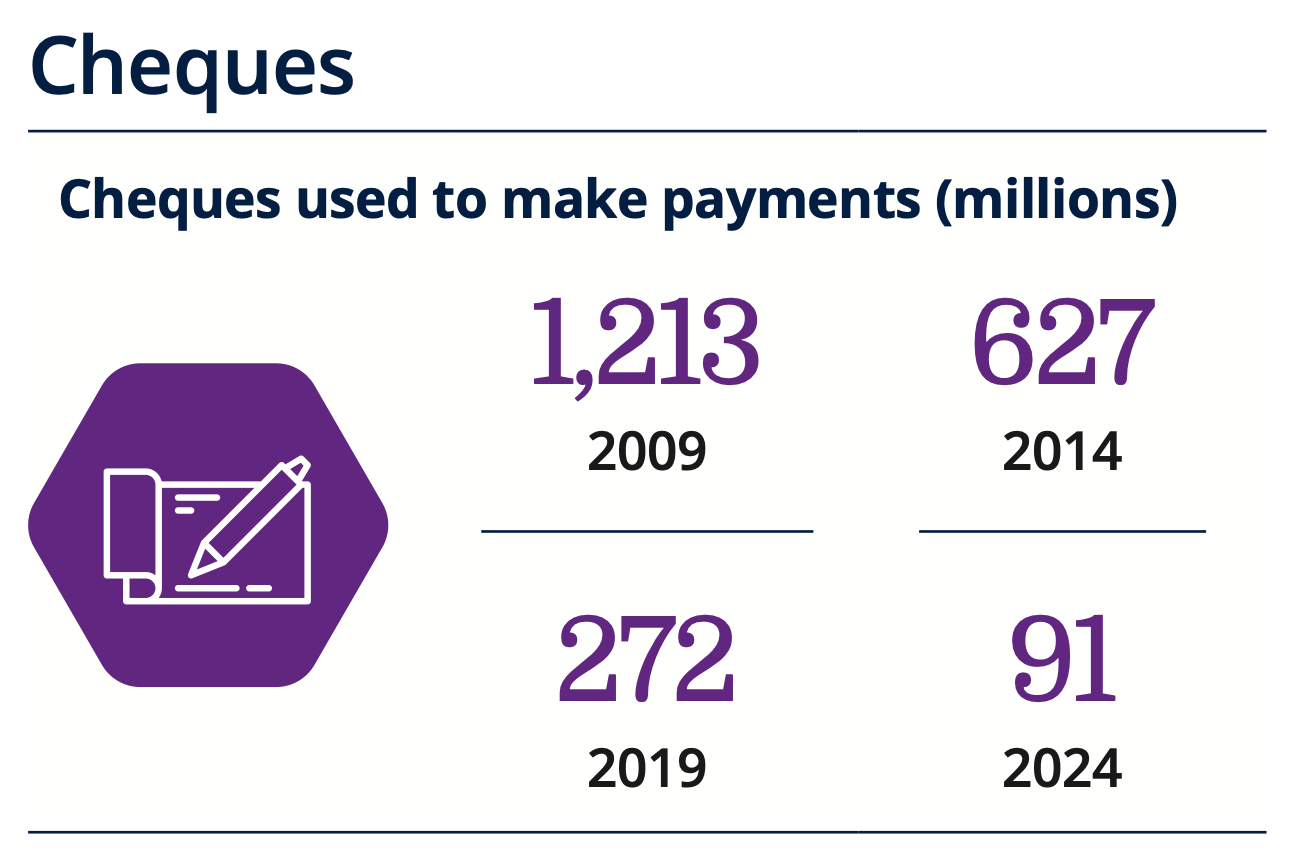

Cheques account for only 0.2% of payments made in the UK

Source: UK Finance

Cheque usage plunged 17% in 2024 to 91 million, as both businesses and consumers increasingly switch to modern payment methods.

Spoiler alert: By November 2025 this had reduced to 81 million!

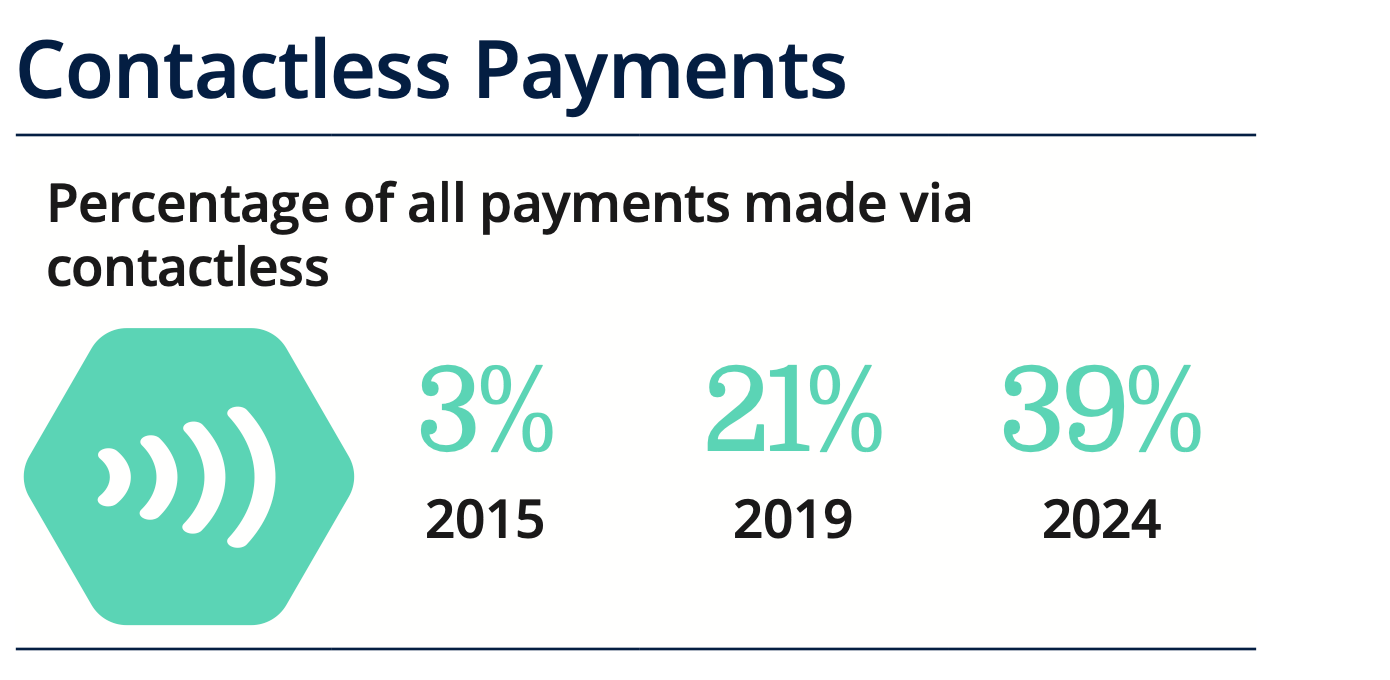

39% of card payments are contactless

Source: UK Finance

Contactless payments in the UK rose to 18.9 billion in 2024, fueled by wider card acceptance and consumer preference over chip and PIN. Mobile payment services like Apple Pay and Google Pay also drove significant growth.

Payment Instrument Growth and Decline 2024 vs 2034

Over the past decade, UK payments have shifted toward debit cards, Faster Payments, and remote banking, with cash declining—and these trends, boosted by Open Banking and mobile wallets, are set to continue.

Understanding UK Payments | 10 Essential Insights

Published the 1 October 2025 25 the “UK Payment Markets 2025” from UK Finance provides detailed commentary on trends in payment markets in 2024 and forecasts up to 2034.

A summary of the report can be found at: UK Finance - UK Payment Markets 2025 and the full report is available free of charge for members of UK Finance and available for purchase by non-members at: www.ukfinance.org.uk

Fuel Payments:Unpacked - your monthly support costs the same as a flat white

Payments:Unpacked is now fully open. From January 2026, all content will be available to every reader.

To support our independent perspective on the payments ecosystem we navigate, we invite readers to contribute £4.35 per month — the price of a flat white.