In this premium edition of Payments:Unpacked we unpack the latest volumes and values of payments processed in the UK through the Bacs, CHAPS, Faster Payments, Cheque, Current Account Switching, LINK and the Debit / Credit Card schemes.

In this latest round up of retail payments, with Covid restrictions largely removed but caution remaining, we see the impact on the volume and value of payments processed in the UK.

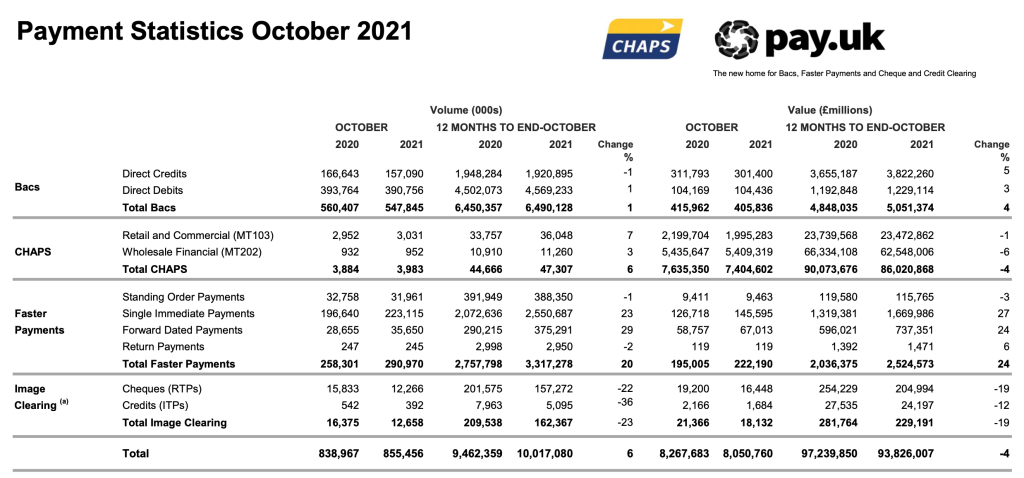

Note: All data is publicly sourced and is the latest available: Pay.UK October 2021, Link November 2021 and UK Finance August 2021.

Bacs Direct Debit and Direct Credit

In the 12 months to the end of October 2021 we see that:

Bacs Direct Credit volumes have decreased by 1% (12 months to September decreased by 1%)

Bacs Direct Debit volumes have increased by 1% (12 months to September increased by 2%)

Total Bacs volumes have increased by 1% (12 months to September increased by 1%)

Bacs Direct Credit values have increased by 5% (12 months to September increased by 5%)

Bacs Direct Debit values have increased by 3% (12 months to September increased by 2%)

Total Bacs values have increased by 4% (12 months to September increased by 4%)

Volumes for Bacs Direct Credits in October 2021 were 6% lower than October 2020 although the year on year reduction in volumes has remained steady at 1% for the 12 months ending October 2021 when compared with the 12 months ending October 2020.

The growth in Direct Debit volumes year on year has fallen back slightly from 2% to 1% for the 12 months to October 2021 when compared with the 12 months to October 2020. As Direct Debits account for 70% of Bacs payment volumes, this increase has contributed to the overall growth recorded in Bacs volumes remaining steady at 1% for this period.

Similarly, despite restrictions easing, month on month values have fallen back below those seen in October 2020. Year on year growth had been increasing each month but has remained steady at 4% for the 12 months to the end of October 2021 when compared with the 12 months ending October 2020.

CHAPS

In the 12 months to the end of October 2021 we see that:

CHAPS volumes have increased by 6% (12 months to September increased by 5%)

This was made up of a 7% increase in retail / commercial based payments and a 3% increase in financial institution payments, compared to 5% increase and 2% increase respectively for the 12 months to September.

CHAPS values have decreased by 4% (12 months to September decreased by 4%)

This month the change was made up of an 1% decrease in retail / commercial based payments and a 6% decrease in financial institution based payments, compared to 1% increase and 6% decrease respectively for the 12 months to September.

Retail / Commercial payment activity had fallen throughout 2020 – however for the month of December volumes just crept ahead of December 2019. Volumes fell back again in January but have recovered since as overall activity has increased as restrictions have eased in 2021. The comparison in October reflects similar conditions across the two years but again shows the increasing activity this year, albeit volumes were just 7% greater in October 2021 compared to October 2020.

The resilience in Wholesale payment volumes has continued although the decrease in value compared to 2020 has continued leading to an overall fall in Wholesale values year on year. This has stabilised in October with the value of Wholesale payments showing a reduction of 6% for the year ending October 2021 compared to the year ending October 2020.

Faster Payments

In the 12 months to the end of October 2021 we see that:

Single Immediate Payment volumes have increased by 24% (12 months to August 26%)

Total Faster Payment volumes have increased by 23% (12 months to September 24%)

Single Immediate Payment values have increased by 27% (12 months to September 27%)

Total Faster Payment values have increased by 24% (12 months to September 24%)

The trend has continued in October with both volumes and values significantly ahead of 2020 levels. October 2021 saw an increase of 13% in the volume of Single Immediate Payments processed in the month compared to 2020 and 15% in the value of Single Immediate Payments.

The increased use of faster payments is a digital payment habit that will be here to stay, reinforced throughout each lockdown over the last 12 months and with volumes and values increasing as restrictions have eased. Further year on year growth is to be expected over the remainder of the year – albeit the trajectory of growth now appears to be flattening.

Cheques

In the 12 months to the end of October 2021 we see that:

Cheque volumes have decreased by 22% (12 months to September 23%).

Cheque values have decreased by 19% (12 months to September 23%).

Despite the introduction of the image-based cheque clearing system, the volumes have continued to drop over the 12 month period. Volumes processed by the Image Clearing System in October were 23% lower than during October 2020. In August the value increased year on year, however for September the value again fell by 12% for September 2021 compared to September 2020. This has occurred again in October 2021 with values falling by 14% compared to October 2020. Thus although usage is falling as many have undoubtedly switched to digital payment options, there is some underlying resilience which continues to be seen in this method of payment.

However, with volumes of digital payments continuing to increase, the share of legacy payments within the total continues to fall. For the twelve months to October 2020 the volume of Cheque payments accounted for 1.9% of the total (for Bacs / CHAPS / Faster Payments and Image Clearing System) falling to 1.4% in October 2021.

Keep reading with a 7-day free trial

Subscribe to Payments:Unpacked to keep reading this post and get 7 days of free access to the full post archives.