In this deep dive newsletter we explore the meteoric rise of Sweden’s Swish system with a guest blog from Jeremy Light’s Agenda:Payments newsletter - huge thanks to Jeremy for allowing Payments:Unpacked to feature “Swish Swish (Part 1)” as a guest blog.

Be sure to subscribe to Jeremy’s excellent Agenda: Payments newsletter at:

Swish Swish (Part 1)

Swish was launched in December 2012 as a real-time person-to-person (P2P) mobile payments network by a group of Swedish banks, in response to the threat of telcos providing alternative payment services.

Next, in 2014 Swish Företag was launched to enable companies to receive Swish payments at point-of-sale and for payment of invoices. This was followed by Swish Handel in January 2016 for ecommerce payments (and in-store integrated into checkouts), Swish Requests for request-to-pay in May 2020 and Swish Payouts for refunds, payroll and business-to-business payments in 20211.

Swish payments are routed to individuals using their mobile phone number and to organisations using a Företag number (always beginning 123) issued by their bank, or by direct integration for online payments using Handel. Usually, retailers in-store embed the 123 number in a QR code displayed on the counter for consumers to capture and pay with their Swish app. Larger retailers also use Handel to integrate Swish directly into their in-store POS systems (which display a QR code – no NFC). All Swish payments are authenticated using the Swedish BankID app embedded in the Swish app.

Swish payments are real-time, 24/7 between bank accounts and are settled real-time through RIX-INST (since February 2024, prior to that through the BiR system). RIX-INST is a clearing and settlement service that runs on a SEK instance of the ECB’s TIPS real-time instant payments system.

Despite the use of RIX-INST since 2022, in Sweden, no real-time payments can be made through online or mobile banking2. Consequently, Swish has evolved into a real-time payments system for everyday banking and bill payments as well as for P2P, in-store and online payments.

Swish Metrics

Swish has about nine million users, 86% of the population. About 320 thousand organisations accept Swish through Företag (123 number/QR code) and about 27 thousand through Handel (online and in-store POS integration)3. In 2024, Swish processed 1.1bn payments, with a value of SEK 560bn (USD 60bn/EUR 51bn). 484m (44%) payments were P2P and 604m (56%) were for commerce. However, users spent more P2P than in commerce – SEK 309bn (USD 33bn/EUR 28bn - 55%) .v. SEK 251 (USD 27bn /EUR 23bn 45%). The average transaction value of a P2P payment was SEK 639 (USD 68/EUR 58) and SEK 415 (USD 44/EUR 38) for a commerce payment.

You can find graphs of Swish payments volumes, values and users going back to 2013 in the Swish 2024 Annual Report.

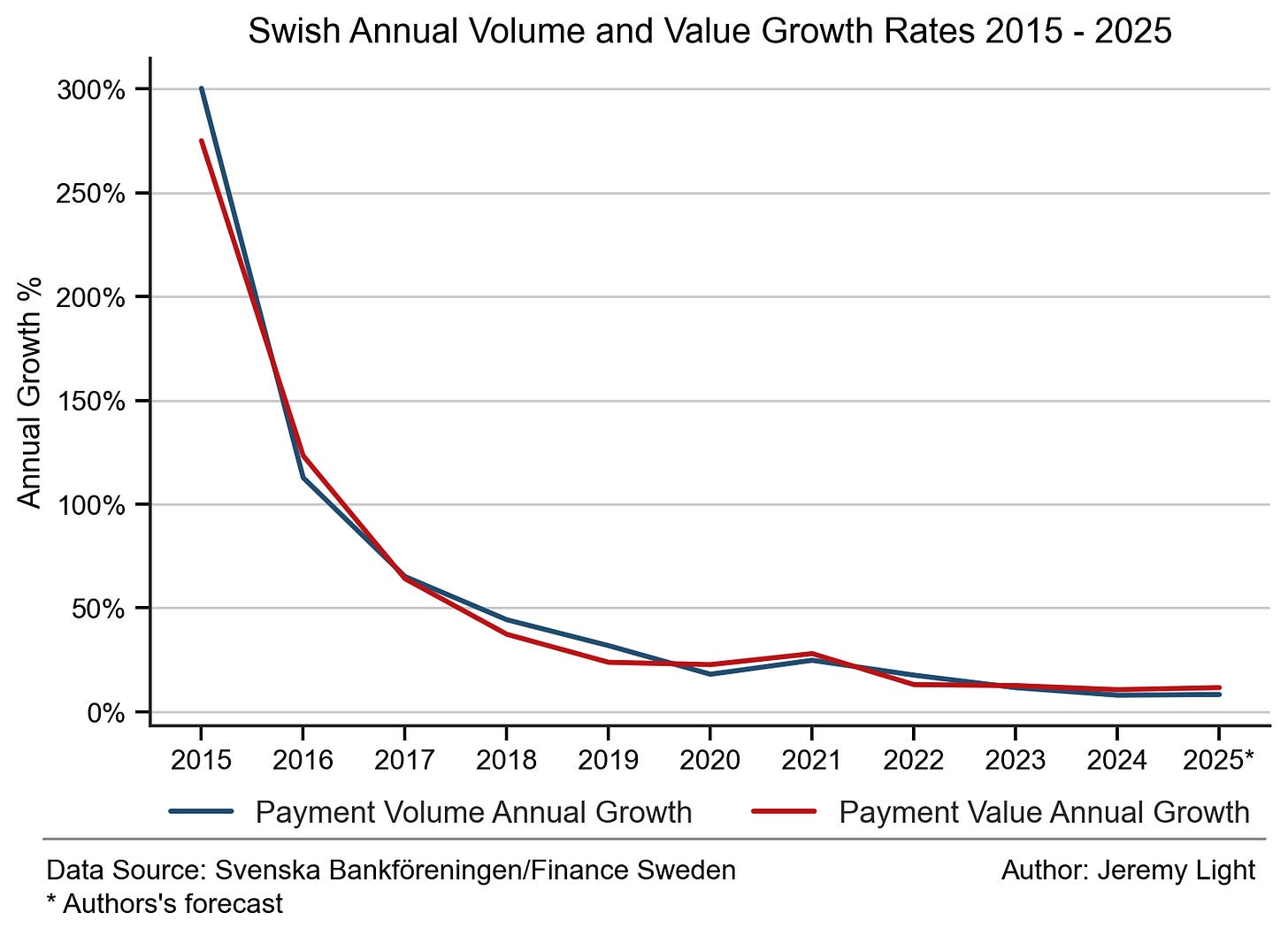

Figure 1 below shows the annual rate of growth Swish payment volumes and values since 2015 (the third full year after launch). Growth rates were above 100% per year for the first four years and have declined since with higher volumes and values, to 8% volume growth and 11% value growth in 2024. This pattern is typical for a payment system as it matures.

Figure 1 – Swish volume and value growth rates

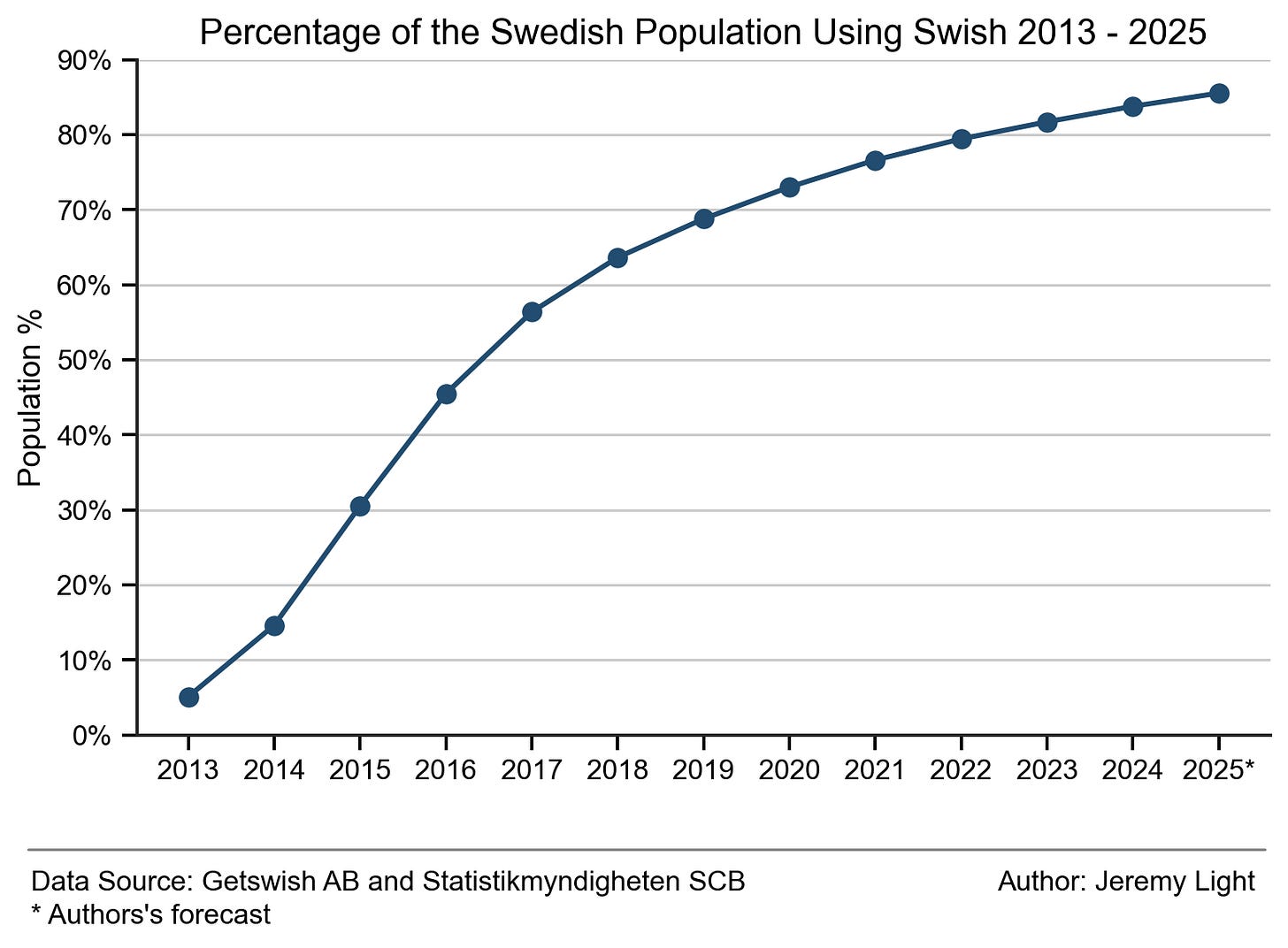

In 2013, the first full year of operation, Swish had 700 thousand users at year-end (7% of the population), with an average of about 490 thousand (5% of the population) for the year. User numbers averaged 1.4m (15% of the population) the following year in 2014. This rapid user take-up in the first few years was an early sign that Swish had a very strong and enduring product market-fit from the start.

Figure 2 plots this path, which has reached almost 9m Swish users today, some 86% of the population.

Figure 2 – Proportion of Swedish population using Swish

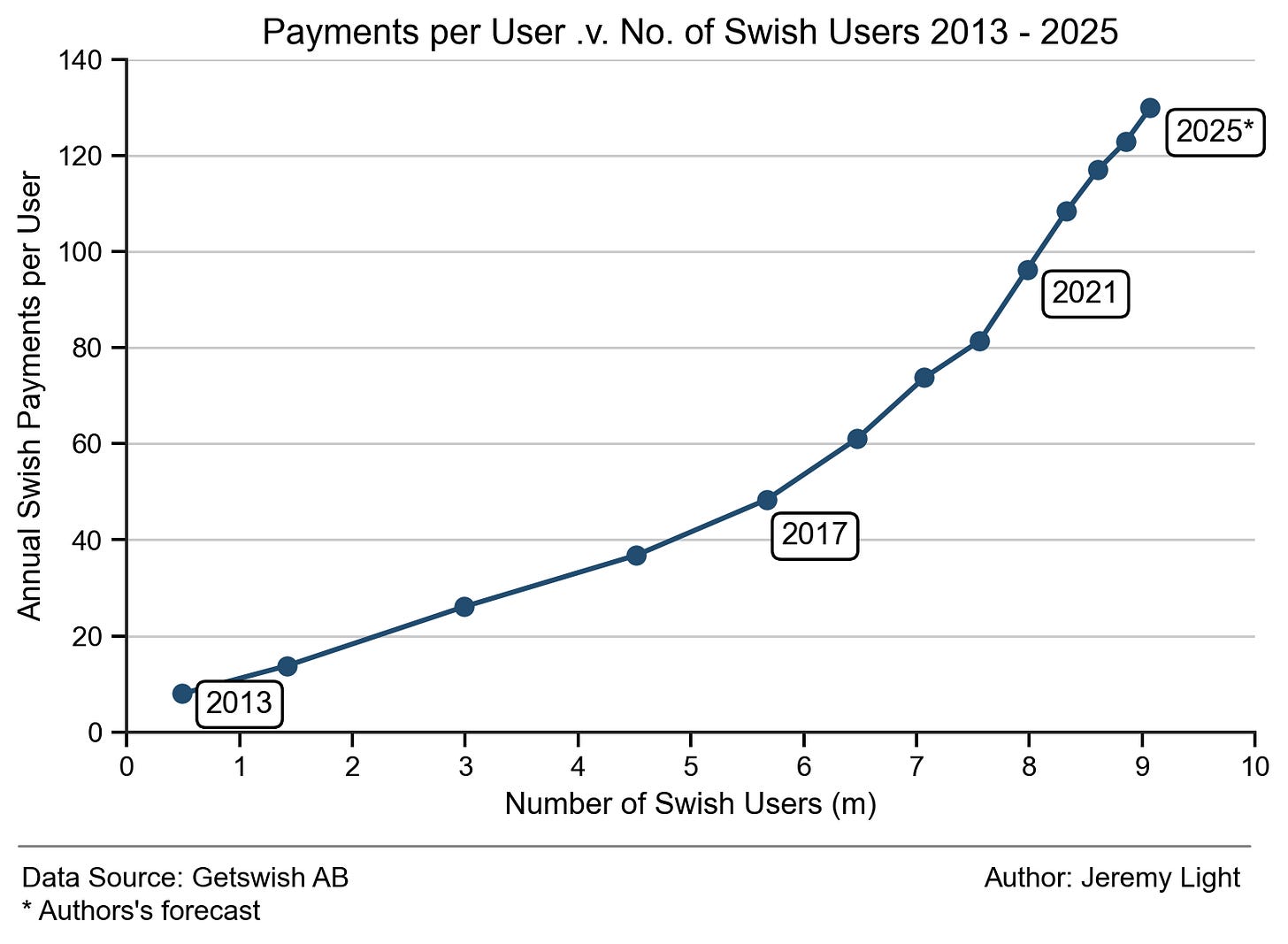

In payments, a strong product-market fit is signalled by strong network effects. Such network effects are evident in Figure 3 from launch and are getting stronger.

It plots the average annual payments per user against the average number of users for each year since launch in 2013, showing clearly that the more users, the higher the payments per user. The network effect being, the more users that came on to the Swish network, the more users to exchange payments, increasing payments per user and transaction volume.

This is a direct effect for P2P transactions. An additional booster network effect comes from organisations joining Swish for commerce and billing. The more organisations that joined, the more places to use Swish, resulting in more payments per user and more users, causing more organisations to join. This is seen in the top right of the graph where the average annual payments per user have accelerated in recent years, particularly when the number of users increased from six million to nine million.

Conclusion

Swish has a very strong product-market fit in Sweden, which has been the case since it was launched 13 years ago. It is a payments network that is getting stronger and stronger, with almost the entire Swedish population using it.

Swish is a powerful case study showing how transaction growth (volume and value), initial user adoption with subsequent user growth and payments per user are key metrics for measuring the success of a payments network. These metrics are essential for planning a new payment service or network and for identifying the factors to drive network effects.

Swish has strong network effects that have resulted in its mass adoption. With almost everyone in Sweden who can use Swish doing so, further growth in volumes and usage (payments per user) will need to be driven from factors other than new users.

Look out for part 2 of Swish Swish next week.

Jeremy Light

Huge thanks to Jeremy Light for allowing Payments:Unpacked to feature “Swish Swish” as a guest blog.

Be sure to subscribe to Jeremy’s excellent Agenda: Payments newsletter at:

Subscribe

Keep reading with a 7-day free trial

Subscribe to Payments:Unpacked to keep reading this post and get 7 days of free access to the full post archives.