Only Three Victors: Exploring the UK's Current Account Switching Service

Issue 609: 8 May 2024

Today’s Payments:Unpacked is brought to you by our new sponsor Wavestone - the largest independent consulting firm in Europe

The Current Account Switch Service reports strong start to 2024, with 320,364 switches taking place in the first quarter.

In the latest Current Account Switch Service (CASS) dashboard, published by Pay.UK, we find out how many of us transferred our bank account in Q1 2024 and who the switching winners and losers were in Q4 2023.

March was the busiest month across the quarter, with a total of 133,356 switches. Small business and charity accounts also saw high switching levels, with 7,075 switches taking place, up 10% from the same period in 2023 (6,421).

2024 current account switching numbers

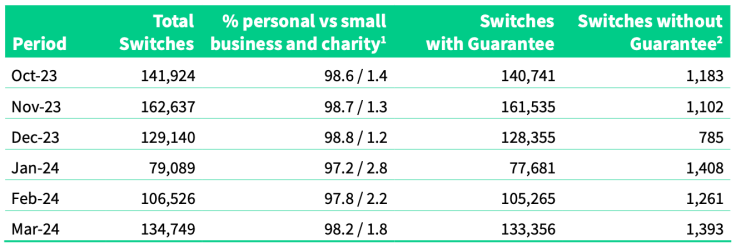

The historic performance of the switching service was severely disrupted by the COVID pandemic, however a clear recovery has taken place. 2023 has seen monthly switch volumes in six figures for ten of the twelve months to date – a feat only achieved three times in the period January 2020 to December 2022. With the exception of the seasonal dip in January, this has continued into 2024 as evidenced in the table below:

Source: Pay.UK

Why do people switch their bank account?

76% of switchers preferred their new current account to their previous one but 2% said that in some ways the new account was worse.

Those who switched current account through the Service over Q1 2024 cited better online or mobile app banking (41%) and interest earned (33%) as the top two reasons for preferring their new account.

Non-financial benefits continued to perform well with customer service (28%), and location of branches (23%) coming in at third and fourth place.

98.7% of switches were completed within the SLA of seven working days.

Small business and charity accounts saw a strong quarter again with 7,075 accounts being switched during the period which was up 10% compared to the same period last year.

People and businesses have more choice than ever

John Dentry, Product Owner at Pay.UK, owner and operator of the Current Account Switch Service, said:

People and businesses have more choice than ever when selecting a banking provider, as we now facilitate switching between 53 different banks and building societies. Cash incentives continue to be a highly effective way for banks to attract customers, but as we repeatedly see through our data, online or mobile app banking remains the top reason why people prefer their new account.

The end of the financial year may have contributed to a spike in switching from businesses, as many spring clean their finances and set themselves up for a successful year ahead. The importance of having the right account for your business should not be understated, and with our easy, free and guaranteed service, businesses can rest assured that their account will be safely transferred if they find an account that better suits their business needs.

Since the launch in September 2013 CASS has facilitated 10.6 million switches and successfully redirected 149.2 million payments.

Q4 2023: Participant performance

Pay.UK publish participant CASS data a quarter in arrears so the latest data provides an insight into switches completed in Q4 2023.

Here’s the winners and losers broken down by participant:

Source: Pay.UK

Of the 53 brand participants in this quarter, three brands recorded a net gain of accounts (last quarter it was 6).

Note: A number of brands are included in a “catch all” low volume participant category which recorded a net loss of -1702 (535 wins and 2,237 losses) so it is possible that an individual brand or two made a small net gain.

Q4 2023: CASS winners and losers by brand

Pay.UK publish the winners and losers information in alphabetical order but sorting based on net gains and losses provides an interesting picture:

Winners

1: Nationwide +163,363

2: Barclays +12,823

3: Lloyds +5,800

Losers

4: Triodos Bank -25

5: Danske: -236

6: Bank of Ireland: -563

7: AIB Group (UK) p.l.c: -807

8: Starling Bank Ltd: -1,712

9: Ulster Bank: -2,587

10: Bank of Scotland: -3,024

11: J.P.Morgan CHASE: -3055

12: HSBC: -3,263

13: Co-operative: – 4,238

14: Monzo Bank Limited: – 5,336

15: Virgin Money: -8,592

16: TSB -10,917

17: RBS -11,621

18: Santander: -34,581

19: Halifax: -41,144

20: NatWest: -43,182

Q4 2023: CASS winners and losers by banking group

Pay.UK publish the winners and losers information in alphabetical order by brand but sorting based on net gains / losses by banking group often provides a different picture.

Winners

For Q4 2023 the top three by group is:

1: Nationwide +163,363

2: Barclays +12,823

3: Triodos -25

Losers

At the other end of the table the picture is as follows when shown by group:

Keep reading with a 7-day free trial

Subscribe to Payments:Unpacked to keep reading this post and get 7 days of free access to the full post archives.