Legacy banks top the switching table

Issue 540 | 27 October 2023

1.2 million switches in past 12 months

In the latest Current Account Switch Service (CASS) dashboard, published by Pay.UK, we find out how many of us transferred our bank account in Q3 2023 and who the switching winners and losers were in Q2 2023.

Spoiler alert: The latest Current Account Switch Service data reveals a 63% increase in switches on the previous year, with 1,399,571 switches having taken place over the twelve months covering 1 October 2022 to 30 September 2023.

Current Account Switch Service facilitates 1.4 million switches in past year

In the latest Current Account Switch Service (CASS) dashboard, published by Pay.UK, we find out how many of us transferred our bank account in Q3 2023 and who the switching winners and losers were in Q2 2023.

The latest Current Account Switch Service data reveals a 63% increase in switches on the previous year, with 1,399,571 switches having taken place over the twelve months covering 1 October 2022 to 30 September 2023.

2023 current account switching numbers

The historic performance of the switching service was severely disrupted by the COVID pandemic, however a clear recovery has taken place. 2023 has seen monthly switch volumes in six figures for seven of the nine months to date – a feat only achieved three times in the period January 2020 to December 2022.

John Dentry, Product Owner at Pay.UK, owner and operator of the Current Account Switch Service, said:

The Current Account Switch Service marked its ten year anniversary this quarter, and in that time the Service has upheld an important role in supporting consumers and businesses change their current account to better suit their needs.

“It is particularly noteworthy that three new customers, Citibank, Allica Bank, and Rothschild, have joined the Service this quarter, enabling greater choice for consumers and demonstrating the significance of the Service.

Since the launch in September 2013 CASS has facilitated 9.8 million switches and successfully redirected 141.4 million payments.

Q3 2023: CASS performance

The CASS insights published by Pay.UK (the operator of the switching service) show us the following monthly switching volumes in Q2 2023 and Q3 2023.

Between July and September 2023, the Current Account Switch Service saw a 55% increase in the number of switches on the same period last year, with a total of 344,195 switches across 51 participating banks and building societies taking place (compared to 222,108 in Q3 2022).

Pay.UK have also published the following service performance insights….

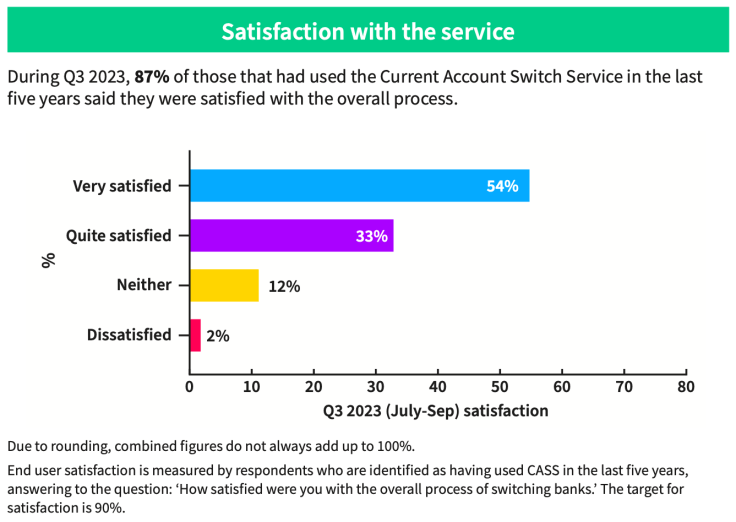

Satisfaction, awareness and confidence

In Q3 2023 the Current Account Switch Service:

achieved satisfaction levels of 87%.

met its awareness target of 75%.

was well regarded with 87% of Current Account Switch Service end users stating that they would recommend the switching service.

Reasons for switching

7 in 10 (71%) switchers preferred their new current account to their previous one:

service-related, non-financial benefits continued to be the main reasons end users preferred their new account.

but 2% said that in some the new account was worse.

Those who switched current account through the Service over Q3 2023 cited better online or mobile app banking (45%) and customer service (32%) as the top two reasons for preferring their new account.

Keep reading with a 7-day free trial

Subscribe to Payments:Unpacked to keep reading this post and get 7 days of free access to the full post archives.