Today’s Payments:Unpacked is brought to you by Bottomline.

Double digit growth (and decline)

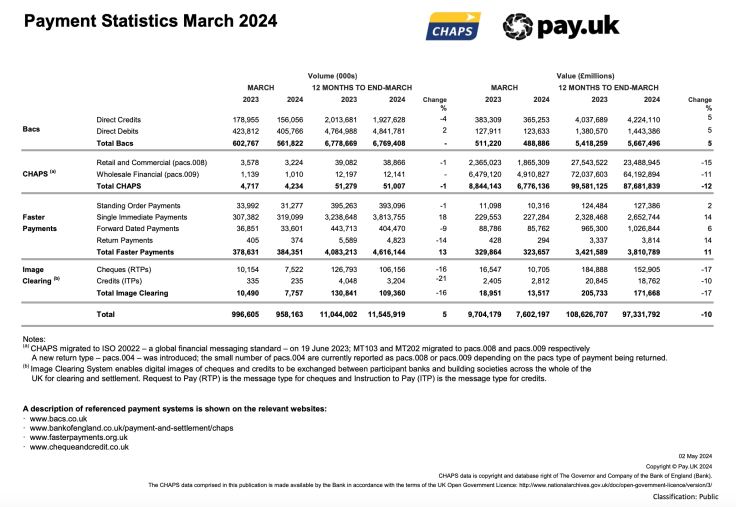

In this end of Q1 2024 round up for retail payments we continue to see double digit growth in the volume and value of Faster Payments and double digit decline in paper clearing.

Note: All data is publicly sourced and is the latest available: Pay.UK March 2024.

Cheques

In the 12 months to the end of March 2024:

Cheque volumes have decreased by 16% (12 months to February decreased by 16%)

Cheque values have decreased by 17% (12 months to February decreased by 15%)

Whilst Faster Payments is experiencing double digit value growth the paper cheque continues to suffer double digit decline – the volume of cheques processed continuing to decrease by 16% over the last 12 months.

Cheque volumes total just under 1% of the total volumes processed by Pay.UK’s schemes (Bacs and Faster Payments) and continued decline in this share is expected as actual volumes decrease and growth continues elsewhere, particularly with Faster Payments.

Faster Payments

In the 12 months to the end of March 2024:

Single Immediate Payment volumes have increased by 18% (12 months to February 19%)

Total Faster Payment volumes have increased by 13% (12 months to February 14%)

Single Immediate Payment values have increased by 14% (12 months to February 16%)

Total Faster Payment values have increased by 11% (12 months to February 13%)

Faster Payments volumes continue to be bolstered by the switch from analogue to digital payments, reinforced during the pandemic and now by the growing importance of Open Banking initiated Account to Account (A2A) payments.

Continued growth in Faster Payments is expected from Open Banking A2A payments and payments initiated by overlay services such as Variable Recurring Payments.

The growth is also likely to be bolstered through the introduction of new Faster Payment types (or flavours) as part of version 1.0 of the planned New Payments Architecture (NPA) and, perhaps, through a future planned migration of Bacs Direct Credit payments into the NPA.

CHAPS

In the 12 months to the end of March 2024:

CHAPS volumes have decreased by 1% (12 months to February increased by 1%)

This was made up of a 1% decrease in retail / commercial based payments and a 0% increase in financial institution payments, compared with 1% increase and 1% increase respectively for the 12 months to February.

CHAPS values have decreased by 12% (12 months to February decreased by 10%).

As the Faster Payments (FPS) participants raise their payment limits to or towards the FPS scheme limit of £1Million we will probably see a gradual reduction in CHAPS volumes.

Given the value of payments initiated by financial institutions, any migration of retail / commercial payments from CHAPS to Faster Payments is not likely in itself to make a significant difference in the value processed.

Bacs Direct Debit and Direct Credit

In the 12 months to the end of March 2024:

Bacs Direct Credit volumes have decreased by 4% (12 months to February decreased by 2%)

Keep reading with a 7-day free trial

Subscribe to Payments:Unpacked to keep reading this post and get 7 days of free access to the full post archives.