Weekly ATM value and volume figures 27 February 2022

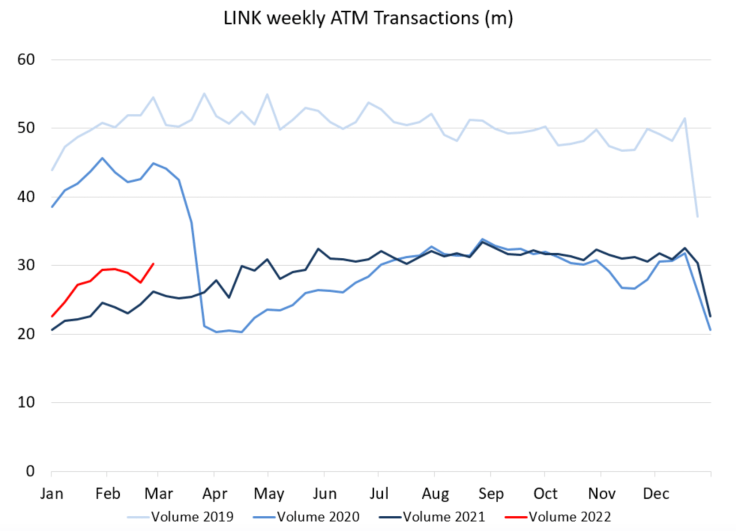

The volume of ATM transactions increased by 10% when compared to the previous week in 2022.

The volume of ATM transactions increased by 16% when compared to the equivalent week in 2021.

The volume of ATM transactions decreased by 33% when compared to the equivalent week in 2020.

Weekly LINK ATM transaction volumes

Last week there was a total of 30.3 million ATM transactions which represents an increase of 2.8 million ATM transactions over the previous week.

In 2022, there was an increase of 4.1 million transactions or 16%when compared with the equivalent week in 2021.

After the usual seasonal fall at the end of December and a slow start to January, activity in 2022 had pulled away from 2021 as expected given the Lockdown restrictions last year. The final weekend has bounced back after the impact from Storm Eunice dampened the previous week and volumes are now back to more expected levels.

From Lockdown 1.0, 2.0, Tiers & 3.0, Steps 1 to 4 out of Lockdown, Plan B and now back to Plan A…

This graph shows the impact on ATM Transactions throughout the first year of lockdowns in 2020 and initially at the beginning of 2021 with Lockdown 3.0. This was followed by a gradual increase in volumes in 2021 as restrictions eased throughout the Summer.

From the Summer months onwards activity across both 2020 and 2021 was very closely matched with the exception of the comparison with Lockdown 2.0 in November 2020.

The usual seasonal fall at the end of December is clearly evidenced in the graph below which follows a usual pattern that can also be seen in 2020 and 2019.

After a slow start to January, the volume of ATM transactions in 2022 continues to track above 2021 although overall volumes remain well below pre-pandemic levels.

ATM Transactions are likely to increase back to the volumes seen in last Summer. Whilst digital payment habits have been reinforced during the pandemic, there is still a consistent underlying level of cash usage by those who need to rely on cash and by those who choose to rely on cash.

Graham Mott, Director of Strategy, LINK said in the report published on 21 January that: “Anecdotally, locations such as markets or even pubs that pre-pandemic only accepted cash, now all have card readers and continue to actively encourage contactless payments. Therefore, some consumers who are confident using digital or contactless payments, now use cash less often than they did pre-pandemic and seem unlikely to ever revert back. However, we know that there are still more than five million people who rely on cash and digital payments are not an option. It’s therefore good news that while ATM and cash use may have fallen, LINK is committed to protecting access and the Government says it will be bringing forward legislation to support access to cash.”

This next graph also shows the trajectory of ATM Transactions with the graph also showing the timing of each lockdown and the differing level of restrictions in place.

Keep reading with a 7-day free trial

Subscribe to Payments:Unpacked to keep reading this post and get 7 days of free access to the full post archives.