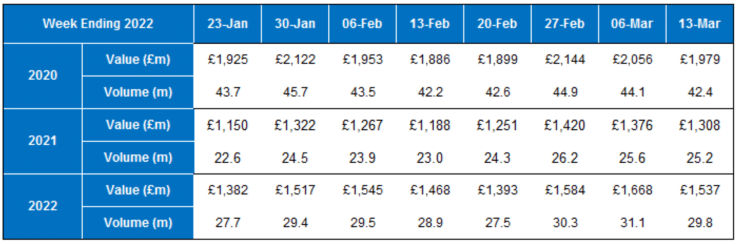

Weekly ATM value and volume figures 13 March 2022

The volume of ATM transactions decreased by 4% when compared to the previous week in 2022.

The volume of ATM transactions increased by 18% when compared to the equivalent week in 2021.

The volume of ATM transactions decreased by 30% when compared to the equivalent week in 2020.

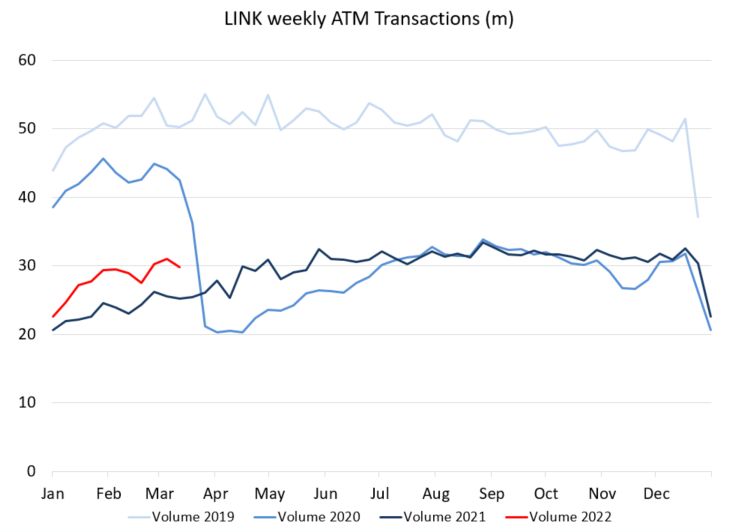

Weekly LINK ATM transaction volumes

Last week there was a total of 29.8 million ATM transactions which represents a decrease of 1.3 million ATM transactions over the previous week.

In 2022, there was an increase of 4.6 million transactions or 18% when compared with the equivalent week in 2021.

After the usual seasonal fall at the end of December and a slow start to January, activity in 2022 had pulled away from 2021 as expected given the Lockdown restrictions last year. Following the usual month end boost, ATM Transaction volumes have now fallen back mid month but would be expected to rise again towards the month end particularly as the school holidays begin at that time.

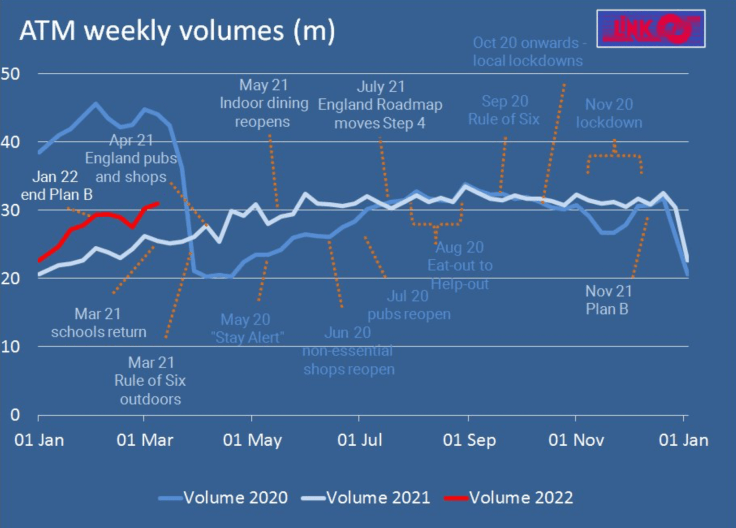

From Lockdown 1.0, 2.0, Tiers & 3.0, Steps 1 to 4 out of Lockdown, Plan B, Plan A and now living with Covid…..

This graph shows the impact on ATM Transactions throughout the first year of lockdowns in 2020 and initially at the beginning of 2021 with Lockdown 3.0. This was followed by a gradual increase in volumes in 2021 as restrictions eased throughout the Summer.

From the Summer months onwards activity across both 2020 and 2021 was very closely matched with the exception of the comparison with Lockdown 2.0 in November 2020. The usual seasonal fall at the end of December is clearly evidenced in the graph below which follows a usual pattern that can also be seen in 2020 and 2019.

After a slow start to January, the volume of ATM transactions in 2022 continues to track above 2021 although overall volumes remain below pre-pandemic levels.

Graham Mott, Director of Strategy, LINK, said in their report published on 21 January that: “Anecdotally, locations such as markets or even pubs that pre-pandemic only accepted cash, now all have card readers and continue to actively encourage contactless payments. Therefore, some consumers who are confident using digital or contactless payments, now use cash less often than they did pre-pandemic and seem unlikely to ever revert back. However, we know that there are still more than five million people who rely on cash and digital payments are not an option. It’s therefore good news that while ATM and cash use may have fallen, LINK is committed to protecting access and the Government says it will be bringing forward legislation to support access to cash.”

his next graph also shows the trajectory of ATM Transactions with the graph also showing the timing of each lockdown and the differing level of restrictions in place.

.Conditions were at their closest over the two years over the Summer with hospitality re-opening at the beginning of July 2020 and with businesses operating under similar restrictions to those currently in place in 2021. The convergence of the graphs shows a consistent level of ATM transactions and value across the two years under these similar conditions.

The two graphs diverged as conditions differed during November but have now converged again as similar restrictions were in place across the two years with both years showing the usual seasonal reduction in volumes at the end of the year.

For the current year transactions can clearly seen to be increasing throughout January and the beginning of February.

In the latest report by LINK published on 4 March 2022, LINK research shows how cash habits have changed through the pandemic. By the end of January 2022, in England, the Government announced an end to Plan B measures. This was the first time LINK conducted the research since summer 2021 and it showed the number of consumers using cash in the last two weeks has now increased to 73%, the highest-level LINK has recorded during the pandemic.

The research also showed a change in where people are using cash. Locations which are showing increasing usage are supermarkets, other retail, services like hairdressing and most especially pubs. This may be a result of those locations starting to accept cash once again, or at least not actively discouraging it. Locations which have shown very little change are convenience stores (by far the most popular location throughout), fuel, DIY stores and parking.

Assuming conditions this year remain unchanged from now on, we would expect the 2021 and 2022 graphs to merge again around May when restrictions were lifted in 2021.

The overall volume and value of transactions had been very subdued throughout each of the Lockdowns compared to pre-pandemic levels as shown in the next graph below. This graph shows the pattern as restrictions began to be eased. Both volumes and values have recovered from the seasonal end of year fall and Plan B restrictions. Volumes are now at around 66% and values around 75% of pre-pandemic levels.

Daily LINK ATM transaction volumes

LINK have provided graphs for Tuesday, Wednesday and Thursday transactions over the last four years which can be seen below.

All show the similarity in the pattern of transactions with 2022 above the Lockdown levels at the beginning of 2021 but well below the early pre-pandemic months in 2020.

Mid month figures have fallen back after the month end boost seen last week but again this pattern is mirrored across the years.

For Thursday, this was just before the last normal weekend in 2020, with big events still on, but shortages in stores meant some were limiting purchases. In 2021 Lockdown 3 was easing with schools back face to face.

Transactions for yesterday and Mondays over the last four years again show the fall after the month end but also 2020 can clearly be seen now just on the brink of the impact from the first Lockdown.

The above graphs are brought together in the following showing Total daily LINK transactions showing the differing conditions over the four years:

Almost two years since the beginning of the first Coronavirus lockdown, LINK, the UK’s main ATM cash machine network has published its latest research looking at COVID-19’s effect on consumers’ attitudes to cash.

Two years on, half of people (50%) say they are using less cash than they were pre-Covid. One quarter (25%) say they are using the same with 4% using more.

Graham Mott, Director of Strategy, LINK: “We monitor ATM use across the UK on a daily basis, but these studies add another layer. After two years of research, we now have a detailed picture of how people are using cash and why throughout the pandemic.

“LINK’s view is that ATM use will never return to pre-pandemic levels and that people who perhaps were using less cash generally are now entirely comfortable using their phones or contactless. That being said, we’re still seeing £1.5bn withdrawn from ATMs every week. That’s still a lot of money and there are a lot of people who rely entirely on cash.

“Looking ahead, one new development and one we will be monitoring carefully, is that 8% of people say they are going to use more cash to budget and save because of rising living costs. We understand that people are far more comfortable using technology, but importantly, not everyone can use digital and perhaps there’s no better way to budget than notes and coins.”

Keep reading with a 7-day free trial

Subscribe to Payments:Unpacked to keep reading this post and get 7 days of free access to the full post archives.