Analogue money in an increasingly digital society

The transition of the UK’s payment habits from analogue to digital reflects a wider societal shift to an increasingly digital society. However, for many, cash is a payment mechanism of choice and / or necessity.

In this edition of Payments:Unpacked we take a look at the latest data on the UK’s daily, weekly, monthly and quarterly cash habits.

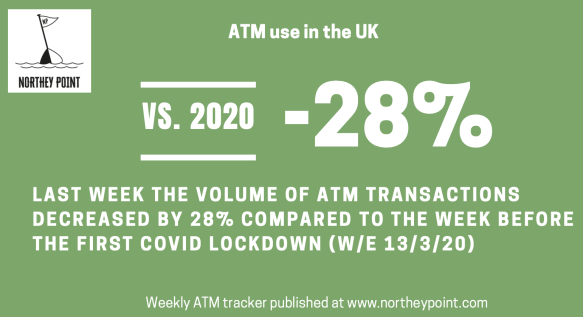

Weekly ATM value and volume figures

For the week ending 06 November 2022:

the volume of ATM Transactions decreased by 28% when compared to the final week before the first COVID lockdown.

the volume of ATM transactions decreased by 2% when compared to the previous week in 2022.

the volume of ATM transactions decreased by 3% when compared to the equivalent week in 2021.

the volume of ATM transactions increased by 5% when compared to the equivalent week in 2020.

Cost of living crisis

LINK, the UK’s cash access and ATM network, has published its latest data showing how people are responding to the cost of living and managing their day-to-day finances.

For more than two years, LINK has been conducting regular research to help understand how cash use is changing in response to COVID-19. While most people and businesses are beginning to move on from the pandemic, this research, conducted in June 2022, looks to identify whether these attitudes are changing in the wake of the rising cost of living in the UK.

The research showed that 10% plan to save money by using contactless less and 9% intend to use cash more frequently. For this latter group, the most popular reasons for intending to use cash more frequently were that doing so

gives them a better idea of how much they’re spending (63%)

helps them to spend less (58%)

helps them to keep track of spending (57%)

and helps with budgeting (57%)

In relation to cash, 68% of adults in the UK have used cash in the past two weeks to pay for something. This is slightly lower than in February (71%) when the research was last conducted.

There are still around 1.1 million consumers who still mainly use cash when doing their day-to-day shopping and this has barely changed since 2020.

There really is a digital divide for those who are and aren’t comfortable using digital payments. For some, card and digital payments mean they can track all their spending online or on the mobile banking. Yet, for many, especially those on fixed or lower incomes, there is no better substitute for budgeting to cash. Not everyone has access to cards or digital payments and they know exactly how much money they have when paying in cash for the bus or in the local shop.

Graham Mott, LINK, Director of Strategy

Daily LINK ATM transaction volumes

The following graph shows the daily withdrawal volumes over the last four years. The impact and bounce back around the bank holiday for the Queen’s funeral can be seen for the volume of transactions – with volumes returning to normal levels on the following days.

The following graph shows the daily withdrawal volumes on Thursdays’ over the last four years.

The volumes are just below last year’s but well above 2020’s when we went into the November lockdown.

Weekly LINK ATM transaction volumes

Keep reading with a 7-day free trial

Subscribe to Payments:Unpacked to keep reading this post and get 7 days of free access to the full post archives.