Picture: Government of Ireland

National Payments Strategy

Last week Ireland’s Minister for Finance, Jack Chambers, launched the National Payments Strategy for Ireland which considers issues including the continuing role of cash in society, payment fraud, and the future of payments in Ireland.

The full report is accessible on the Irish Government’s Department of Finance’s website (National Payment Strategy).

In launching the strategy the Minister said:

The Irish payments landscape is very different today than 10 years when the previous iteration of this Strategy was put in place. Consumers are increasingly turning to digital means of payment, be they card payments, or tapping to pay at retail outlets with smartphones or watches. There has also been much discussion around the decline in the use of cash for day-to-day payments and the need to protect this form of payment which remains the preferred form of payment for so many in our society, including older people.

To ensure the Irish economy benefits from the advantages of emerging technologies and payment methods, while also taking into account the need to ensure the continued availability of more traditional forms of payments, this Strategy sets out a vision for the future of payments in Ireland.

Jack Chambers, Minister for Finance, Ireland.

National Payments Strategy

At nearly a 100 pages Ireland’s payments strategy is a comprehensive and useful read - before you download the strategy we share ten key insights contained in the new national payments strategy for Ireland.

1: A vision for payments

The goal of Ireland’s National Payments Strategy is to ‘enhance and build public trust in and the effectiveness of the payments system’, based on four interlocking principles:

Source: Government of Ireland

2: Strategic issues addressed

The consultation process focussed on nine key payment issues:

Source: Government of Ireland

3: Ireland’s Electronic Payments Landscape

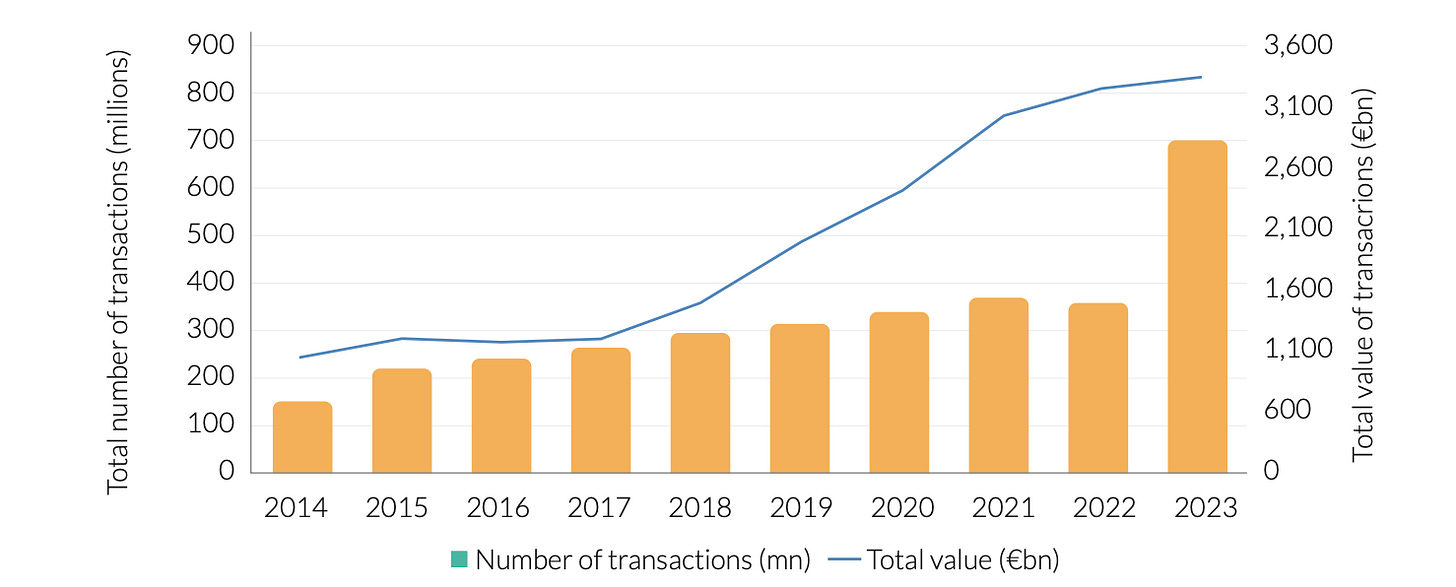

The annual number of electronic payment transactions between 2014 and 2023:

Source: Central Bank of Ireland

4: Use of cash

The strategy finds that cash continues to play a significant role in Ireland’s economy and society. Data from the Central Bank shows that in May 2024, €1.1 billion was withdrawn in over eight million transactions at ATMs and at retail outlets in Ireland.

Over the last decade, the number of cash withdrawals from ATMs rose to a peak in 2018 and, except for seasonal variation, declined up to March 2023 - although it appears that the average amount per withdrawal could be continuing to decline.

Access to cash is predominantly via ATMs, with 74 per cent of consumers reporting that they generally access cash from them for day-to-day transactions. Withdrawals at bank branches, at retailers, and at post offices are also used by significant numbers of people to obtain cash, and many people use more than one source.

The Consumer Sentiment Banking Survey August 2024, conducted on behalf of the Department of Finance, found that 23 per cent of all adults in Ireland prefer paying by cash in-store. In the 2023 and 2022 surveys, that preference was, respectively, 23 per cent and 22 per cent. That preference was stronger in those over the age of 65, at 50 per cent, an increase from 39 per cent in 2022 and 43 per cent in 2023.

The ECB’s Study on the Payment Attitudes of Consumers in the euro Area (SPACE) – 2022 found that for 64 per cent of respondents in Ireland, having the option to pay by cash is either very important or fairly important. This was the joint highest in the euro area countries. The average across all euro area countries was 60 per cent.

The strategy states that in order to exercise the right to pay by cash, consumers need to be able to access cash, and maintaining access to cash is a priority for the Minister for Finance.

The Finance (Provision of Access to Cash Infrastructure) Bill 2024 will provide for sufficient and effective infrastructure for access to cash, and for managing future changes to the access to cash infrastructure in a fair, orderly, transparent, and equitable manner. The access to cash criteria ensures that cash infrastructure is maintained, initially, at December 2022 levels.

The Bill sets three criteria against which access will be measured

the number of people in a region19 who are within a certain radius of an ATM

the number of ATMs per 100,000 people in the region

the number of people within a certain radius of a cash service point.

The Bill will provide for the Minister for Finance to make regulations that prohibit ATM operators from charging an access fee for withdrawing cash from an account held in an EU member state, or to set a maximum fee that an ATM operator may charge.

More:

UK comparison: Five things you need to know about acquiring cash.

5: A niche future role for cheques

Source: Central Bank of Ireland

The strategy notes that the second oldest form of payment that has been widely used is cheques, though they constitute a relatively minor portion of payment transactions overall, both in number of transactions and the value of transactions.

In the fourth quarter of 2023, cheques constituted 0.5 per cent of the total value and 0.3 per cent of the total number of transactions reported by the Central Bank in its Payment Statistics Quarterly report.

None of the submissions in the consultation on the National Payments Strategy asked for the use of cheques to be stopped. Given that a small number of respondees highlighted that there is an ongoing demand for cheques, albeit for niche areas, that there was no strong call for cheques to be removed from the payments system, and that the use of them is declining, this Strategy does not contain any recommendation for phasing out cheques.

6: Cards represent 59% of the total number of payment transactions

By far the most common method of payment in Ireland is by card, accounting for 59 per cent of the total number of payment transactions in 2023, as reported by the Central Bank in its Payment Statistics Quarterly report.

Source: Central Bank of Ireland

The startegy notes that six firms issue credit cards in Ireland: the three long-standing retail banks, An Post, and two more recent entrants to the market, namely, Avant and Revolut. Behind the six card issuers, the market is dominated by two major global firms, Mastercard and Visa, which provide the card infrastructure used by the card issuers. There are challenges to having only two firms provide card services, including concentration risk, which affects resilience, competition and choice.

The number of national card schemes across the EU has been declining, and now only seven of the twenty euro area countries have national card schemes20. In 2019, the ECB reported that the number of national card schemes across the EU had declined between 2013 and 2018, through a combination of a reduction in the number of national card schemes in three member states and the complete closure in one member state (Ireland).21 Between 1996 and 2014, a number of Irish banks and building societies issued Laser debit cards.

7: Credit transfers represent more that 95% of value of payment transactions

Source: Central Bank of Ireland

Credit transfers account for more than 95 per cent of the value of all recorded digital payments in Ireland in Q4 2023 (€2.6 trillion of the €2.7 trillion), although they account for only 26 per cent of the number of payment transactions

There was an abrupt increase in the number of credit transfers in the second quarter of 2023, when the number more than doubled in a single quarter, from 95.7 million transfers in January to March to 192.2 million transfers in April to June.

The strategy states that the narrative component of the Central Bank’s Payment Statistics Quarterly attributes the change in the number of transactions to the entry of a new payment service provider to the Irish market.

8: Direct Debits are not a focus of significant legislative or market changes

The number of direct debit transactions grew slightly from 2022 to 2023, at 2.2 per cent, and stood at 182 million transactions while the value grew at a somewhat higher rate of 9 per cent (probably reflecting the effect of inflation) to €198 billion. In 2023, direct debit transactions accounted for just under 2 per cent of the value of payments and just over 4 per cent of the number of payments.

Although the value and number of payments by direct debit are lower than other payment methods and direct debits are not a focus of significant legislative or market changes, they continue to be a key method of payment for certain types of economic activity.

By definition, a direct debit transaction is initiated by the payee, and they are frequently used for regular payments, both where the amount to be paid is fixed, such as subscriptions, or where the amount varies, such as for utility bills.

Government of Ireland

9: Electronic money has a mixed role in the payments landscape

Electronic money has a mixed role in the payments landscape in Ireland. The value of e-money transactions is a little lower than the value of cheque payments (respectively €103 billion and €106 billion in 2023) but the number of e-money transactions is more than 24 times the number of cheques written and represents 8.5 per cent of overall transactions.

A significant limitation of the data from the Central Bank is that it covers only electronic money institutions that are domiciled in Ireland. The largest provider for Ireland (and Europe) is not domiciled in the country, so the data does not reflect its activity in Ireland.

10: A focus on two (connected) strategic enablers

One of the aims of the Strategy is to support the development of new payment methods, particularly those that leverage new and emerging technologies in the Irish and European payments ecosystem such as digital wallets, instant payments, QR codes, and request-to-pay (RTP) facilities.

A gap has been identified in the Irish payments market, in comparison with other European countries, in the ability to make payments online or in person, from a bank or credit union account directly to another account, without an intermediary instrument, such as a card. To put this simply, it is ‘pay by account’ or ‘pay by my account’. An account-to-account is a payment used to directly transfer money from one account to another account without the need for any additional payment intermediaries – pay by account.

Government of Ireland

Two strategic enablers are identified to address this gap - Open Banking and Instant Payments.

And a bonus item - 11: Future Outcomes

Keep reading with a 7-day free trial

Subscribe to Payments:Unpacked to keep reading this post and get 7 days of free access to the full post archives.