Subscribe and share

Welcome to our latest new subscribers and a huge thank you to those that recommended Payments:Unpacked to a friend this week - these recommendations are having a huge impact on subscriber numbers!

99p? That’ll be a £1 please

The Isle of Man is set to become the first place that accepts Sterling to encourage businesses to round payments to the nearest five pence - with the overseas territory’s treasury saying they won’t mint any more copper coins so if there is a shortage businesses should round receipts to the nearest five pence.

Although new to Sterling Sweden introduced rounding in 1972 and “penny rounding” is also common in New Zealand and Canada.

In the Republic of Ireland price rounding was introduced on a voluntary basis in 2015 but retailers must still charge the exact advertised price if requested.

The UK government said “We have no current plans to change the denominational mix of UK coins.”

SurePay Launches Developer Portal to empower UK PSPs to implement Confirmation of Payee

SurePay, the pioneer behind Confirmation of Payee, has introduced the SurePay Developer Portal, an innovative platform designed to empower developers with the full potential of SurePay’s offerings.

This announcement comes at a pivotal time as the Payment Systems Regulator (PSR) mandates hundreds of Payment Service Providers (PSPs) in the UK to implement Confirmation of Payee (CoP) over the next 12 months.

The SurePay Developer Portal acts as the gateway for UK PSPs to explore SurePay’s product suite effectively. Inside the portal, you’ll discover:

Up-to-Date API Documentation: Gain access to the most recent SurePay API specification, Postman collections, and Yaml files. This ensures you have all the essential information for seamless integration with the CoP API.

Code Examples: Explore code samples that demonstrate how to connect and leverage SurePay’s capabilities within your applications, simplifying CoP integration.

Integration Guidance: Detailed instructions on connecting with SurePay’s offerings, making it easier than ever to incorporate CoP into your payment solutions.

Status Updates and FAQs: Stay informed about our API’s status and find answers to the most frequently asked questions.

To access the SurePay Developer Portal and embark on your path towards Confirmation of Payee innovation and efficiency, visit https://developer.surepay.co.uk/ and take a closer look.

PIX and UPI a quick comparison

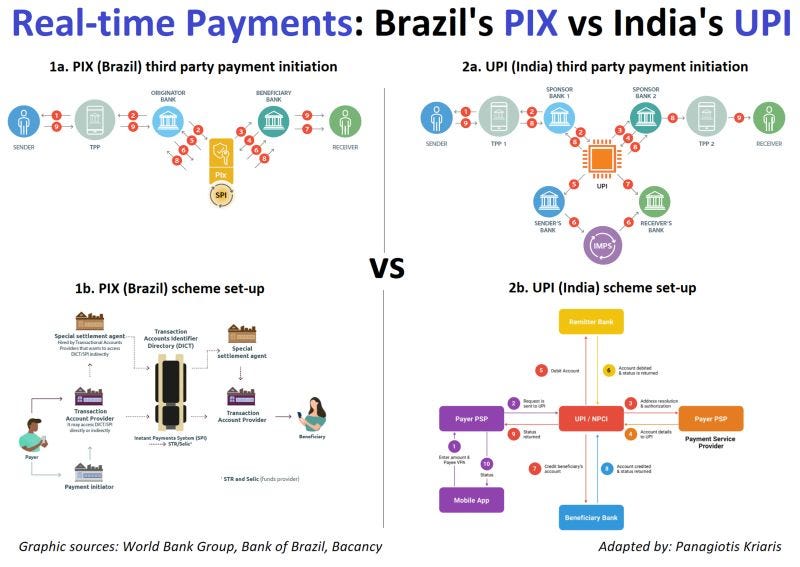

India launched UPI in 2016 and in just 7 years it managed to become the most popular online payment method with over 300 mn active users and 10 bn transactions monthly.

Developed by the National Payments Corporation of India (NPCI) and regulated by the Reserve Bank of India (RBI), UPI is a real-time payment system that powers multiple bank accounts into a single app.

Brazil launched Pix in late 2020 and in March 2023 reached 3 bn monthly transactions. Pix was introduced as part of a broader agenda to modernize the Brazilian financial system and foster financial inclusion. Besides supporting various use cases (QR, wallets, etc) Pix has been also building alternatives for credit cards, direct debit and recurring payments.

More: Join Panagiotis Kriaris as he looks at the similarities / differences between the two solutions.

Open Banking Impact Report

According to Open Banking Limited over 1 in 9 Brits now use open banking services as open banking payments reach record high:

9.7m payments made in June 2023, an increase of 88% on the same month in 2022. We have seen further growth since the cut-off point for this report (June 2023), with 10.8m payments made in August 2023.

Double the volume of payments in the first six months of 2023 than was seen in the first six months of 2022.

The average transaction value of open banking payments is around £450, meaning the total monthly value of open banking payments is around £4.5bn.

Over 1 in 9 (11%) British consumers are active users of open banking, and 17% of small businesses.

Open Banking Limited (OBL) has published its latest Open Banking Impact Report, which covers the six months to June 2023. For the first time, enhanced data from Pay.UK shows that the total monthly value of open banking payments is sitting at around £4.5bn.

New Payments Architecture

The New Payments Architecture (NPA) is the UK's industry program of organising interbank payments. As the world rapidly changes, the need for a modernised system that lowers barriers to entry, introduces stronger security and increases interoperability has become essential.

In this Sibos TV interview Shane Warman, NPA Programme Director of Pay.UK explains how NPA will facilitate the development of different payments business models and drive innovative new products and services.

Al Etihad Payments launches Aani: an instant payments platform for digital transactions in the UAE

It was my privilege to play a very small part on this launch of Aani in the UAE - Aani transforms the way UAE pays for the goods and services it consumes.

What is a stablecoin?

A stablecoin is a form of digital asset that can be used to make payments.

It isn't like the cash you carry, or the money in your bank which is held on a central record by your bank. It is an asset that could be created, for example, by a technology company, rather than a bank.

Stablecoins are backed by a specified asset or basket of assets which they use to maintain a stable value against that asset. This is usually a country’s currency, such as the US dollar. This makes stablecoins different from cryptoassets which tend not to have assets as backing, and are more volatile.

Right now, stablecoins are mainly used for:

buying or selling cryptoassets

making payments across a country’s border (known as ‘cross-border payments’)

An example of a cross-border payment is when someone sends money to family or friends in another country. But, because stablecoins have a stable value, people may start using them more to pay for a wider range of things.

More from the Bank of England: What is a stablecoin?

Last week premium subscribers also received: The EU is getting its version of Confirmation of Payee.

Payments Manifesto

Last week I published my payments manifesto - feedback welcome!

Running to the Old Lady

A short story from my early days in banking:

Lloyds Bank issues urgent warning over rising threat of crypto scams

A growing number of British investors risk being defrauded by a wave of fake adverts posted on social media, according to a new a warning issued by Lloyds Bank.

The number of cryptocurrency investment scams reported1 by victims so far this year has risen by 23%, compared to the same period in 2022.

The average amount lost by each victim of a crypto investment scam is £10,741 (up from £7,010 last year). This is more than any other type of consumer fraud (such as romance scams or purchase scams).

Remarkably, the analysis found that 66% of all investment scams start on social media – with Instagram and Facebook the most common sources. This includes a mix of bogus ads, fake celebrity endorsements, and targeting through direct messages.

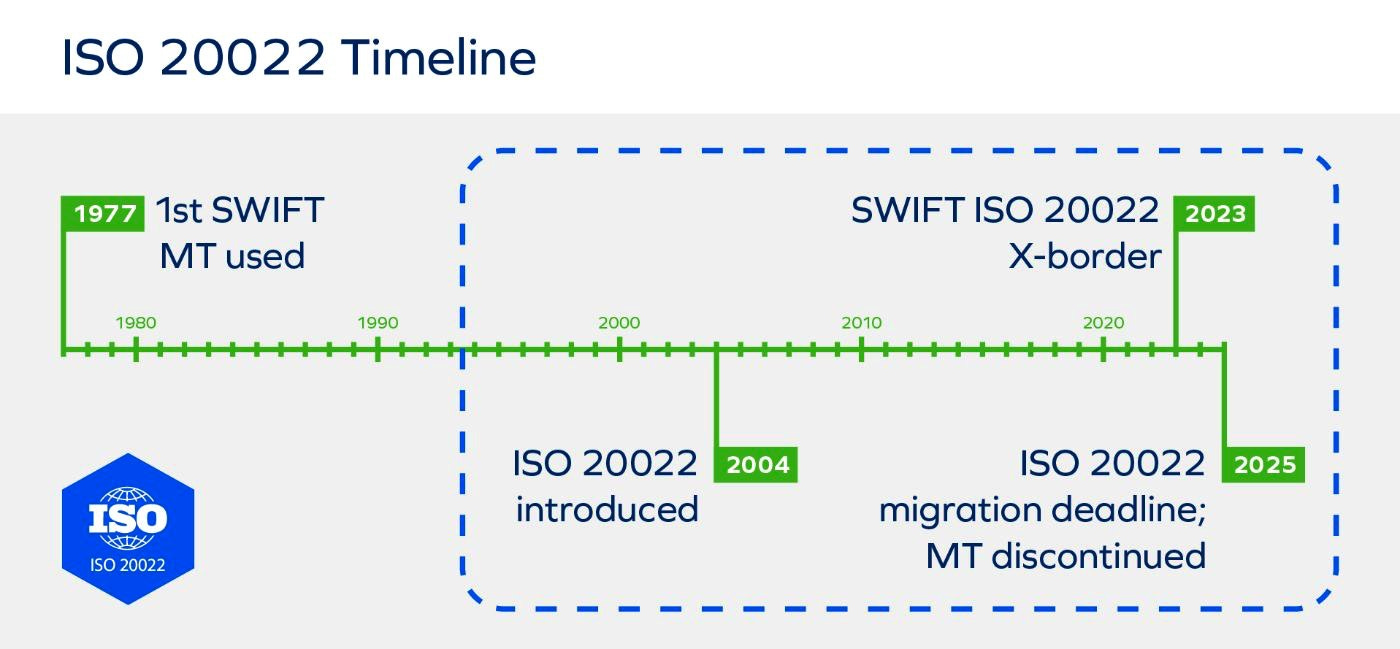

Understanding ISO 20022

Instant and cross border payments are high on the list of priorities for businesses and authorities worldwide, yet interoperability and integration between different clearing systems has been a challenge hindering meaningful progression. That’s why ISO 20022 will be a game changer once it becomes an official messaging standard. Yet for novices, this is a complex concept. This article is a beginner’s guide to ISO 20022 and why standardisation of financial messaging standards is so crucial.

ISO 20022 is an international messaging standard that offers transparency, speed and higher interoperability to the global payments sector. In simple terms, it’s an international standards framework that enables a common language for relaying electronic messages between financial institutions. ISO 20022 will replace ISO 15022, which is the current messaging standard.

More: Understanding ISO20022 (H/T Paul Simpson).

In brief

How will the PSR's new APP fraud rules impact banks' inbound transaction processing? from Nick Fleetwood at Form3.

Operating as a Bacs and FPS indirect participant from Matthieu Blandineau at Numeral.

Former UK government minister Gavin Williamson has been cleared to take up a position on the advisory board of fintech Lanistar. Separately, the startup, which has previously found itself in hot water with the FCA, has ended its Electronic Money Directive (EMD) agent relationship with Modulr.

Having already left the US and UK, German digital bank N26 is quitting the Brazilian market as it narrows its focus on continental Europe.

Today’s Payments:Unpacked is brought to you by Lerex.

Lerex has embraced a fresh visual aesthetic which serves as an impactful representation of the company’s growth and transformation. The evolving identity captures our progress and embraces the future of Lerex.

Lerex has built a dynamic, flexible, complete solution for digital finance. It can be readily customised and adapted for our clients’ business and brand, rapidly with minimal disruption and maximum peace-of-mind. Our B2B service allows our clients to provide banking solutions including eWallets, payment cards and GBP / EUR accounts, which in turn allows them to build trust with their customers.